Semiconductor Wafer Reclaim Services Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities. Explore Market Size, Forecasts, and Competitive Dynamics Shaping the Industry.

- Executive Summary and Market Overview

- Key Technology Trends in Wafer Reclaim Services

- Competitive Landscape and Leading Players

- Market Growth Forecasts and CAGR Analysis (2025–2030)

- Regional Market Analysis and Emerging Hotspots

- Future Outlook: Innovations and Strategic Opportunities

- Challenges, Risks, and Market Opportunities

- Sources & References

Executive Summary and Market Overview

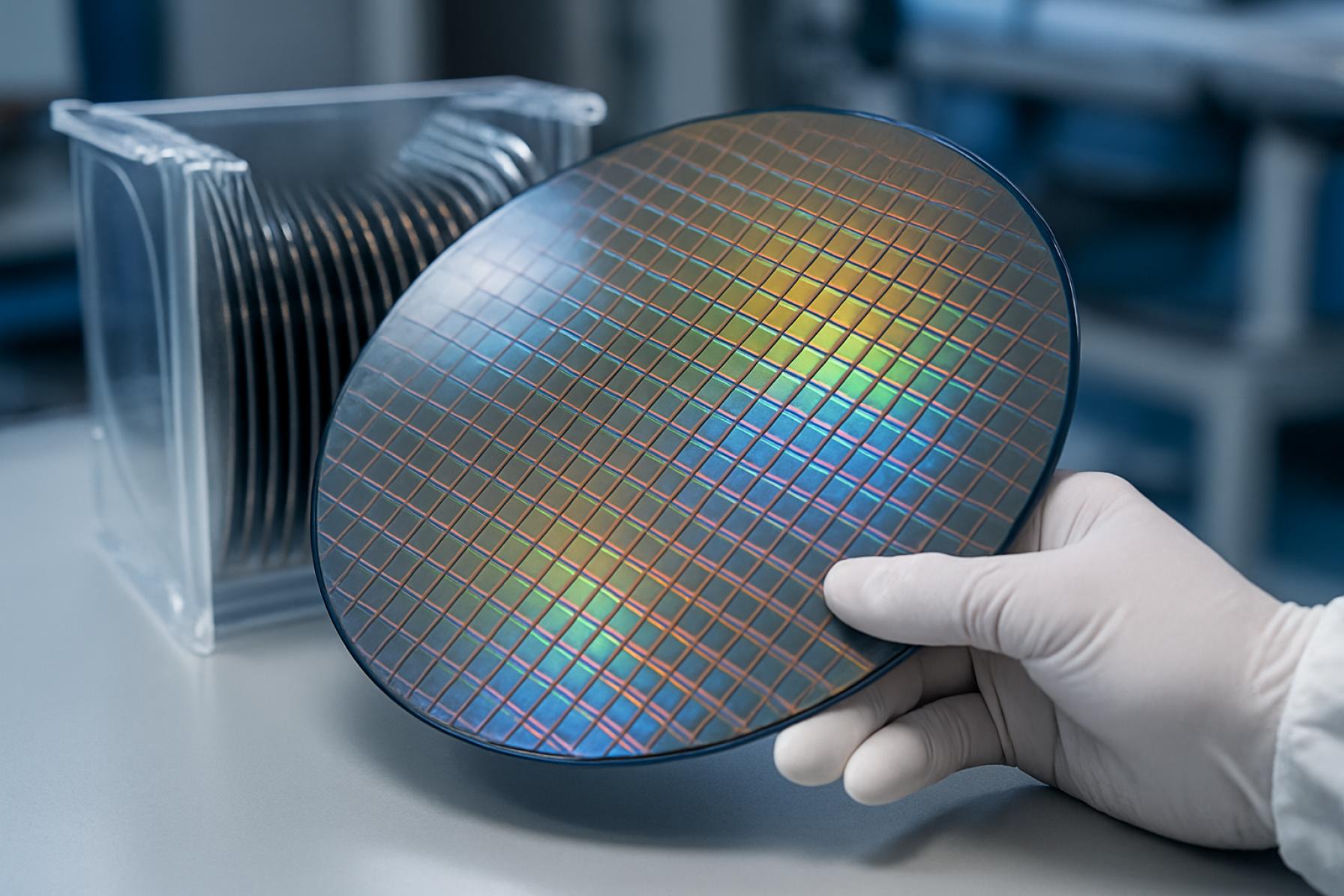

The global market for semiconductor wafer reclaim services is poised for significant growth in 2025, driven by the increasing demand for cost-effective manufacturing solutions and the ongoing expansion of the semiconductor industry. Wafer reclaim services involve the process of restoring used or test semiconductor wafers to a condition suitable for reuse in manufacturing, metrology, or equipment testing. This practice not only reduces material costs but also supports sustainability initiatives by minimizing waste.

In 2025, the market is expected to benefit from robust semiconductor demand across sectors such as consumer electronics, automotive, and industrial automation. The proliferation of advanced technologies—including 5G, artificial intelligence, and the Internet of Things (IoT)—is fueling the need for more efficient and sustainable wafer processing solutions. According to SEMI, global semiconductor sales are projected to maintain a strong upward trajectory, which directly correlates with increased wafer consumption and, consequently, a higher volume of wafers available for reclaim.

Key players in the wafer reclaim services market, such as ULVAC, Advantest Corporation, and Technomark, are investing in advanced cleaning, polishing, and inspection technologies to improve yield and quality. These innovations are critical as device geometries shrink and quality requirements become more stringent. The Asia-Pacific region, led by countries like Taiwan, South Korea, and China, continues to dominate the market due to its concentration of semiconductor fabrication facilities and strong government support for the electronics sector (IC Insights).

Market challenges include the technical complexity of reclaiming advanced node wafers and the need for continuous investment in process technology. However, the economic and environmental benefits of wafer reclaim—such as reduced raw material costs and lower carbon footprint—are expected to drive adoption further. The market is also witnessing increased collaboration between foundries and reclaim service providers to ensure supply chain resilience and meet sustainability targets (Gartner).

In summary, the semiconductor wafer reclaim services market in 2025 is characterized by strong growth prospects, technological innovation, and a strategic focus on sustainability. As the semiconductor industry continues to evolve, reclaim services will play an increasingly vital role in supporting both economic and environmental objectives.

Key Technology Trends in Wafer Reclaim Services

The semiconductor wafer reclaim services market in 2025 is being shaped by several key technology trends that are enhancing both the efficiency and sustainability of wafer processing. As the semiconductor industry faces mounting pressure to reduce costs and environmental impact, reclaim services are evolving rapidly to meet these demands.

One of the most significant trends is the adoption of advanced chemical-mechanical planarization (CMP) and cleaning technologies. These innovations enable service providers to remove residual films and contaminants more effectively, resulting in higher yield rates for reclaimed wafers. Companies are investing in proprietary slurry formulations and precision polishing equipment to minimize wafer loss and improve surface quality, which is critical for applications in test and metrology processes ULVAC, Inc..

Automation and digitalization are also transforming wafer reclaim operations. The integration of artificial intelligence (AI) and machine learning algorithms into inspection and sorting systems allows for real-time defect detection and classification, reducing human error and turnaround times. Automated material handling systems further streamline the workflow, enabling higher throughput and consistency in reclaimed wafer output Lasertechnik Berlin GmbH.

Another notable trend is the expansion of reclaim services to accommodate a broader range of wafer sizes and materials. With the proliferation of compound semiconductors such as silicon carbide (SiC) and gallium nitride (GaN) in power electronics and RF applications, reclaim providers are developing specialized processes to handle these substrates. This diversification is opening new revenue streams and supporting the circular economy within the semiconductor supply chain Siltronic AG.

Environmental sustainability is increasingly at the forefront of technology development in this sector. Providers are implementing closed-loop water recycling systems and eco-friendly chemical processes to reduce waste and comply with stringent environmental regulations. These initiatives not only lower operational costs but also enhance the marketability of reclaimed wafers to environmentally conscious customers SUMCO Corporation.

In summary, the wafer reclaim services market in 2025 is characterized by technological advancements in cleaning, automation, material diversity, and sustainability. These trends are enabling service providers to deliver higher quality, more cost-effective, and environmentally responsible solutions to the semiconductor industry.

Competitive Landscape and Leading Players

The competitive landscape of the semiconductor wafer reclaim services market in 2025 is characterized by a mix of established global players and specialized regional providers, each vying for market share through technological innovation, capacity expansion, and strategic partnerships. The market is moderately consolidated, with a handful of key companies dominating, but there is also a notable presence of niche firms catering to specific geographic or technological segments.

Leading players in this sector include Pure Wafer, Advantest Corporation, Siltronic AG, KST World Corp., and Wafer World Inc.. These companies have established robust global supply chains and offer comprehensive reclaim services, including wafer cleaning, polishing, and inspection, to meet the stringent quality requirements of semiconductor manufacturers.

In 2025, Pure Wafer continues to lead the North American market, leveraging its advanced reclaim technologies and strong relationships with major foundries and integrated device manufacturers (IDMs). The company’s investments in automation and process optimization have enabled it to deliver high-yield reclaimed wafers, supporting the industry’s push for cost efficiency and sustainability.

In Asia-Pacific, KST World Corp. and Siltronic AG are prominent, benefiting from proximity to major semiconductor manufacturing hubs in Taiwan, South Korea, and China. These firms have expanded their service portfolios to include larger wafer sizes (up to 300mm), addressing the evolving needs of advanced node production. Advantest Corporation has also strengthened its position through strategic alliances and by integrating wafer reclaim with its broader semiconductor test and measurement solutions.

Smaller players, such as Wafer World Inc., focus on niche markets and custom reclaim solutions, often serving research institutions and specialty device manufacturers. These companies differentiate themselves through flexibility, rapid turnaround times, and the ability to process a wide variety of wafer materials and specifications.

Overall, competition in 2025 is intensifying as sustainability pressures and cost reduction imperatives drive semiconductor manufacturers to increase their reliance on reclaimed wafers. Leading providers are responding by investing in R&D, expanding global footprints, and enhancing service quality to capture a larger share of this growing market segment.

Market Growth Forecasts and CAGR Analysis (2025–2030)

The global market for semiconductor wafer reclaim services is poised for robust growth between 2025 and 2030, driven by escalating demand for cost-effective semiconductor manufacturing and sustainability initiatives within the electronics industry. According to projections from MarketsandMarkets, the wafer reclaim market is expected to register a compound annual growth rate (CAGR) of approximately 6–8% during this period. This growth trajectory is underpinned by the increasing adoption of reclaimed wafers in process monitoring, equipment testing, and research and development, as semiconductor manufacturers seek to optimize production costs and reduce material waste.

In 2025, the market size for semiconductor wafer reclaim services is estimated to reach around USD 600 million, with Asia-Pacific maintaining its dominance due to the concentration of major foundries and integrated device manufacturers in countries such as Taiwan, South Korea, and China. The region’s leadership is further reinforced by government policies promoting circular economy practices and the presence of key industry players such as ULVAC and Siltronic AG.

From 2025 to 2030, the market is anticipated to benefit from several factors:

- Technological Advancements: Innovations in wafer reclaim processes, including improved cleaning, polishing, and inspection techniques, are enhancing the quality and yield of reclaimed wafers, making them increasingly viable for advanced semiconductor applications.

- Rising Demand for Consumer Electronics: The proliferation of smartphones, IoT devices, and automotive electronics is fueling wafer consumption, thereby increasing the volume of wafers available for reclaim and the need for efficient reclaim services.

- Environmental Regulations: Stricter environmental standards and corporate sustainability goals are compelling semiconductor manufacturers to adopt reclaim services as part of their waste reduction strategies.

By 2030, the global semiconductor wafer reclaim services market is projected to surpass USD 900 million, with the CAGR remaining steady in the mid-to-high single digits. The competitive landscape is expected to intensify, with established providers expanding their service portfolios and new entrants leveraging advanced automation and AI-driven inspection systems to capture market share. Overall, the period from 2025 to 2030 will be characterized by steady, innovation-driven growth, underpinned by both economic and environmental imperatives in the semiconductor industry (Global Market Insights).

Regional Market Analysis and Emerging Hotspots

The global market for semiconductor wafer reclaim services is experiencing dynamic regional shifts, driven by the evolving semiconductor manufacturing landscape and the increasing emphasis on cost optimization and sustainability. In 2025, Asia-Pacific continues to dominate the market, accounting for the largest share due to the concentration of semiconductor fabrication plants in countries such as Taiwan, South Korea, China, and Japan. The region’s leadership is underpinned by the presence of major foundries and integrated device manufacturers (IDMs), including TSMC, Samsung Electronics, and UMC, all of which are significant consumers of reclaimed wafers for equipment calibration, process monitoring, and cost-effective production.

North America remains a critical market, buoyed by the United States’ strategic investments in domestic semiconductor manufacturing and supply chain resilience. The Semiconductor Industry Association reports that U.S. government incentives and private sector investments are spurring the expansion of wafer fabrication capacity, which in turn is increasing demand for reclaim services to manage operational costs and reduce material waste. Key players in this region, such as Intel and GlobalWafers, are actively integrating reclaim solutions into their sustainability initiatives.

Europe is emerging as a hotspot, particularly in light of the European Union’s “Chips Act” and the push for technological sovereignty. Countries like Germany, France, and the Netherlands are witnessing new fab announcements and expansions, with companies such as Infineon Technologies and STMicroelectronics driving regional demand for wafer reclaim services. The focus on circular economy principles and environmental regulations is further accelerating adoption in this region.

- Emerging Hotspots: Southeast Asia (notably Singapore and Malaysia) is gaining traction as a regional hub for both semiconductor manufacturing and ancillary services, including wafer reclaim, due to favorable government policies and growing foreign direct investment.

- India is also on the radar, with government-backed initiatives to establish a domestic semiconductor ecosystem, which is expected to create new opportunities for reclaim service providers by 2025 and beyond.

Overall, the regional market landscape for semiconductor wafer reclaim services in 2025 is characterized by robust growth in Asia-Pacific, strategic expansion in North America and Europe, and the emergence of new hotspots in Southeast Asia and India, all underpinned by the twin imperatives of cost efficiency and sustainability.

Future Outlook: Innovations and Strategic Opportunities

The future outlook for semiconductor wafer reclaim services in 2025 is shaped by rapid technological innovation, evolving sustainability mandates, and the strategic repositioning of semiconductor manufacturers. As the industry faces mounting pressure to optimize costs and reduce environmental impact, wafer reclaim services are emerging as a critical lever for both economic and ecological gains.

One of the most significant innovations anticipated in 2025 is the advancement of reclaim technologies that enable higher yields and improved wafer quality. Enhanced cleaning, polishing, and inspection processes are expected to allow for the reclamation of advanced node wafers, including those below 10nm, which were previously considered too delicate or contaminated for reuse. Companies are investing in proprietary chemistries and precision metrology tools to minimize surface defects and particle contamination, thereby extending the usable life of reclaimed wafers for test, monitor, and even some production applications.

Strategically, leading semiconductor foundries and integrated device manufacturers (IDMs) are expected to deepen partnerships with specialized reclaim service providers. This collaboration is driven by the need for secure, traceable, and high-throughput reclaim processes that align with stringent quality standards. Some industry players are also exploring in-house reclaim capabilities to gain tighter control over supply chains and intellectual property, particularly as geopolitical tensions and supply disruptions persist.

From a sustainability perspective, regulatory and customer-driven demands for greener manufacturing are accelerating the adoption of wafer reclaim. The process significantly reduces raw material consumption and waste generation, supporting corporate ESG goals and compliance with emerging environmental regulations in key markets such as the EU and Asia-Pacific. According to SEMI, the global push for circular economy practices in semiconductor manufacturing is expected to drive double-digit growth in the wafer reclaim segment through 2025.

Strategic opportunities also lie in the expansion of reclaim services to new wafer types, such as silicon carbide (SiC) and gallium nitride (GaN), which are increasingly used in power electronics and electric vehicles. As these materials become more prevalent, reclaim providers that can develop specialized processes for non-silicon substrates will be well-positioned to capture emerging market share.

In summary, 2025 will see semiconductor wafer reclaim services at the intersection of innovation, sustainability, and strategic supply chain management. Companies that invest in advanced technologies and forge robust partnerships will be best equipped to capitalize on the sector’s evolving opportunities.

Challenges, Risks, and Market Opportunities

The semiconductor wafer reclaim services market in 2025 faces a complex landscape of challenges, risks, and emerging opportunities. As the semiconductor industry continues to grapple with supply chain disruptions and increasing demand for advanced chips, wafer reclaim services—where used wafers are refurbished for test, monitoring, or secondary manufacturing—are gaining strategic importance.

Challenges and Risks

- Technological Complexity: The transition to smaller process nodes (e.g., 5nm and below) and the adoption of advanced materials such as silicon carbide (SiC) and gallium nitride (GaN) complicate the reclaim process. Reclaiming wafers with ultra-thin layers or complex structures requires sophisticated equipment and expertise, raising operational costs and technical barriers for service providers (SEMI).

- Quality Assurance: As device manufacturers demand higher yields and reliability, the quality standards for reclaimed wafers are becoming more stringent. Any contamination or micro-defect can lead to significant losses, making quality control a critical risk factor (TSMC).

- Supply Chain Volatility: Ongoing geopolitical tensions and raw material shortages can disrupt the availability of used wafers for reclaim, as well as the chemicals and consumables required for the process (Gartner).

- Environmental Regulations: Increasingly strict environmental and waste management regulations in key markets such as the EU, US, and China add compliance costs and operational complexity for reclaim service providers (U.S. Environmental Protection Agency).

Market Opportunities

- Cost Savings and Sustainability: The drive for cost reduction and circular economy practices is pushing semiconductor manufacturers to increase their use of reclaimed wafers. This trend is especially pronounced among foundries and integrated device manufacturers (IDMs) seeking to optimize resource utilization (Infineon Technologies).

- Expansion into New Materials: The growing adoption of SiC and GaN in power electronics and EVs opens new avenues for specialized reclaim services, as these materials become more prevalent in wafer production (Yole Group).

- Emerging Markets: Rapid semiconductor industry growth in Southeast Asia and India is creating fresh demand for local reclaim services, offering expansion opportunities for global and regional players (SEMI).

Sources & References

- ULVAC

- Advantest Corporation

- IC Insights

- Siltronic AG

- Pure Wafer

- KST World Corp.

- Wafer World Inc.

- MarketsandMarkets

- Global Market Insights

- Semiconductor Industry Association

- Infineon Technologies

- STMicroelectronics