Quantum Photonic Hardware Engineering Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities. Explore Key Trends, Forecasts, and Competitive Insights Shaping the Industry’s Future.

- Executive Summary & Market Overview

- Key Technology Trends in Quantum Photonic Hardware (2025–2030)

- Competitive Landscape and Leading Players

- Market Growth Forecasts and Revenue Projections (2025–2030)

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

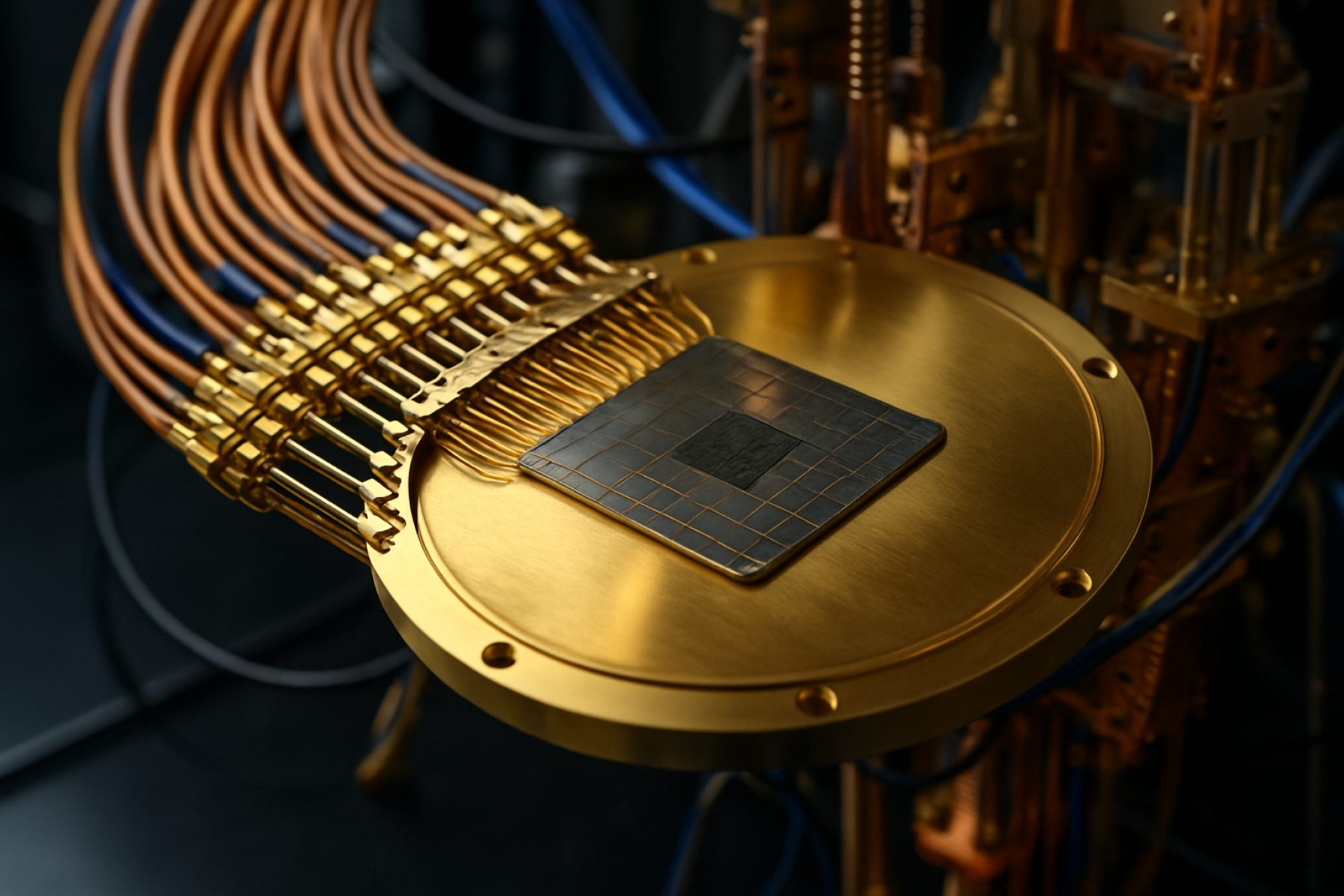

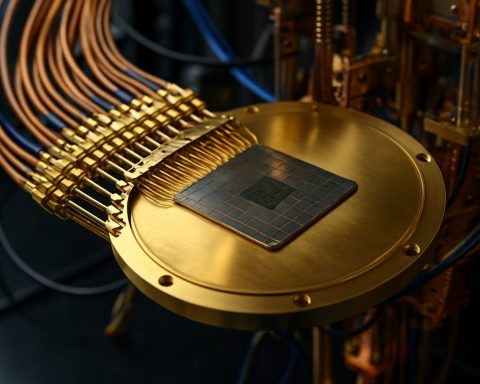

Quantum photonic hardware engineering refers to the design, fabrication, and integration of photonic devices and systems that leverage quantum mechanical properties of light for advanced computing, communication, and sensing applications. As of 2025, this sector is at the forefront of the broader quantum technology market, driven by the pursuit of scalable, room-temperature quantum computers and ultra-secure quantum communication networks.

The global quantum photonic hardware market is experiencing rapid growth, with projections estimating a compound annual growth rate (CAGR) exceeding 30% through 2030, fueled by increased investment from both public and private sectors. Key drivers include the demand for high-performance quantum processors, advances in integrated photonics, and the need for secure data transmission in critical infrastructure. According to International Data Corporation (IDC), the quantum computing market—including photonic hardware—could surpass $8.6 billion by 2027, with photonics-based approaches gaining a significant share due to their scalability and operational advantages.

Major industry players such as PsiQuantum, Xanadu, and ORCA Computing are pioneering the development of photonic quantum processors, leveraging silicon photonics and integrated optical circuits to address challenges in qubit scalability and error correction. These companies have attracted substantial funding rounds, reflecting strong investor confidence in photonic quantum hardware as a viable path to practical quantum advantage.

Government initiatives are also accelerating market momentum. The European Union’s Quantum Flagship program and the U.S. National Quantum Initiative are channeling significant resources into photonic quantum hardware research and commercialization, fostering collaboration between academia, startups, and established technology firms (European Commission; National Quantum Initiative).

Despite the optimism, the market faces technical hurdles, including photon loss, integration complexity, and the need for high-efficiency single-photon sources and detectors. However, ongoing advances in nanofabrication, materials science, and hybrid integration are steadily mitigating these challenges, positioning quantum photonic hardware engineering as a critical enabler of the next wave of quantum technologies.

Key Technology Trends in Quantum Photonic Hardware (2025–2030)

Quantum photonic hardware engineering is rapidly evolving, driven by the need for scalable, stable, and high-fidelity quantum systems. In 2025, several key technology trends are shaping the landscape, with a focus on integrating photonic components, improving quantum light sources, and advancing error correction techniques.

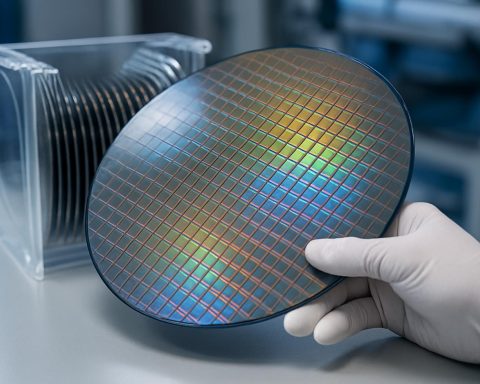

- Integrated Photonic Circuits: The miniaturization and integration of photonic components onto single chips is a primary trend. Companies and research institutions are leveraging silicon photonics and hybrid material platforms to fabricate complex quantum circuits with higher yield and reproducibility. This integration is crucial for scaling up quantum processors and reducing system footprint, as demonstrated by advances from Paul Scherrer Institute and imec.

- On-Demand Single-Photon Sources: The development of deterministic, high-purity single-photon sources is a major engineering focus. Quantum dots, color centers in diamond, and nonlinear optical processes are being refined to deliver indistinguishable photons at telecom wavelengths, which is essential for quantum communication and networking. National Institute of Standards and Technology (NIST) and Toshiba Corporation have reported significant progress in this area.

- Low-Loss, High-Fidelity Components: Reducing optical losses and improving the fidelity of photonic gates and switches are critical for practical quantum computing. Innovations in waveguide design, low-loss materials, and advanced fabrication techniques are enabling more robust quantum operations. Xanadu and PsiQuantum are at the forefront, developing hardware with record-low loss and high operational stability.

- Quantum Error Correction and Fault Tolerance: Hardware-level error correction is becoming increasingly important as systems scale. Photonic implementations of surface codes and bosonic codes are being engineered to mitigate decoherence and operational errors, with University College London and IBM Quantum leading research in this domain.

- Hybrid Quantum Systems: There is a growing trend toward integrating photonic hardware with other quantum modalities, such as superconducting qubits and trapped ions, to leverage the strengths of each platform. This hybridization aims to enhance connectivity, memory, and processing capabilities, as explored by Rigetti Computing and Quantinuum.

These engineering trends are expected to accelerate the commercialization and practical deployment of quantum photonic hardware through 2025 and beyond, setting the stage for breakthroughs in quantum computing, secure communications, and advanced sensing applications.

Competitive Landscape and Leading Players

The competitive landscape of quantum photonic hardware engineering in 2025 is characterized by rapid innovation, strategic partnerships, and a growing influx of investment from both established technology giants and specialized startups. The field is driven by the race to achieve scalable, fault-tolerant quantum computing and secure quantum communication, with photonic approaches gaining traction due to their potential for room-temperature operation, high-speed data transmission, and integration with existing fiber-optic infrastructure.

Leading players in this sector include Paul Scherrer Institute, which has made significant advances in integrated photonic circuits for quantum applications, and Xanadu, a Canadian startup that has developed the Borealis quantum computer based on photonic qubits. PsiQuantum, headquartered in Silicon Valley, is another major contender, focusing on building a million-qubit quantum computer using silicon photonics and leveraging partnerships with semiconductor foundries for scalable manufacturing.

European players such as Quantum Flagship and QuiX Quantum are also prominent, with QuiX Quantum delivering programmable photonic quantum processors and collaborating with research institutions to accelerate commercialization. In Asia, NTT Research and NICT (National Institute of Information and Communications Technology, Japan) are investing heavily in photonic quantum hardware, focusing on both quantum computing and secure quantum networks.

- Xanadu: Pioneering continuous-variable photonic quantum computing, with a focus on cloud-accessible quantum hardware and open-source software tools.

- PsiQuantum: Targeting large-scale, fault-tolerant quantum computers using silicon photonics, with significant funding and industry partnerships.

- QuiX Quantum: Specializes in photonic quantum processors and integrated photonic chips, with a strong presence in the European market.

- NTT Research: Focuses on quantum networking and photonic integration, leveraging Japan’s advanced telecom infrastructure.

The competitive environment is further shaped by collaborations between hardware developers, academic institutions, and government initiatives, such as the Quantum Flagship program in Europe. As the market matures, differentiation is increasingly based on scalability, error rates, and the ability to integrate with classical systems, positioning photonic hardware as a key battleground in the quantum technology race.

Market Growth Forecasts and Revenue Projections (2025–2030)

The quantum photonic hardware engineering market is poised for significant expansion in 2025, driven by escalating investments in quantum computing, secure communications, and advanced sensing technologies. According to projections from International Data Corporation (IDC), the global quantum computing market—including hardware, software, and services—could surpass $8.6 billion by 2027, with photonic hardware constituting a rapidly growing segment due to its scalability and room-temperature operation advantages.

In 2025, revenue from quantum photonic hardware engineering is expected to reach approximately $450 million, reflecting a compound annual growth rate (CAGR) of 38–42% from 2023 levels, as estimated by Boston Consulting Group (BCG). This growth is underpinned by increased demand for photonic quantum processors, integrated photonic circuits, and single-photon sources and detectors, which are essential for both quantum computing and quantum networking applications.

Key industry players such as PsiQuantum, Xanadu, and ORCA Computing are expected to accelerate commercialization efforts in 2025, with several pilot projects and early-access quantum photonic systems being deployed for research and enterprise use. The European Union’s Quantum Flagship initiative and the U.S. National Quantum Initiative are also anticipated to inject substantial funding into photonic hardware R&D, further boosting market momentum (Quantum Flagship).

- Enterprise Adoption: Financial services, pharmaceuticals, and logistics sectors are projected to be early adopters, leveraging quantum photonic hardware for optimization and simulation tasks.

- Geographic Trends: North America and Europe will dominate market share in 2025, but significant growth is expected in Asia-Pacific, particularly in China and Japan, due to robust government support and emerging startups.

- Revenue Breakdown: The majority of 2025 revenues will stem from hardware sales and custom engineering services, with a growing share from cloud-based quantum access and hardware-as-a-service models.

Overall, 2025 will mark a pivotal year for quantum photonic hardware engineering, setting the stage for exponential revenue growth and broader commercialization through 2030 as technical barriers are overcome and ecosystem partnerships mature (McKinsey & Company).

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for quantum photonic hardware engineering in 2025 is characterized by distinct investment patterns, research intensity, and commercialization strategies across North America, Europe, Asia-Pacific, and the Rest of the World. Each region leverages unique strengths, regulatory frameworks, and industrial ecosystems to advance quantum photonics, shaping the global competitive environment.

- North America: The United States and Canada remain at the forefront, driven by robust funding from both government initiatives and private sector investments. The National Science Foundation and U.S. Department of Energy have significantly increased grants for quantum photonics research, while companies like IBM, Northrop Grumman, and PsiQuantum are accelerating hardware development. The region benefits from a mature semiconductor supply chain and strong university-industry collaborations, particularly in Silicon Valley and Boston.

- Europe: The European Union’s Quantum Flagship program continues to drive cross-border research and commercialization, with countries like Germany, the Netherlands, and the UK leading in photonic chip fabrication and integration. Companies such as Xanadu (with European partnerships) and Rigetti Computing (with a UK presence) are expanding their hardware capabilities. Europe’s emphasis on open innovation and standardization is fostering a collaborative ecosystem, though regulatory complexity can slow market entry.

- Asia-Pacific: China, Japan, and South Korea are rapidly scaling investments in quantum photonic hardware. The Chinese government’s State Council has prioritized quantum technologies in its five-year plans, supporting companies like Origin Quantum and Baidu. Japan’s RIKEN and South Korea’s Samsung are also advancing photonic integration and quantum communication hardware. The region’s manufacturing prowess and government backing are accelerating prototype-to-product cycles.

- Rest of World: While less dominant, countries such as Australia, Israel, and Singapore are emerging as innovation hubs. Australia’s University of Sydney and Israel’s Weizmann Institute of Science are notable for pioneering research and spin-offs in quantum photonics. These regions often focus on niche applications and international partnerships to compensate for smaller domestic markets.

Overall, regional disparities in funding, talent, and infrastructure are shaping the pace and direction of quantum photonic hardware engineering, with North America and Asia-Pacific leading in commercialization, and Europe excelling in collaborative research and standardization.

Future Outlook: Emerging Applications and Investment Hotspots

Quantum photonic hardware engineering is poised for significant advancements in 2025, driven by both technological breakthroughs and a surge in strategic investments. As quantum computing and secure communications transition from theoretical promise to practical deployment, photonic hardware—leveraging photons for information processing—has emerged as a critical enabler for scalable, room-temperature quantum systems.

Emerging applications are rapidly expanding beyond traditional quantum computing. Quantum photonic chips are increasingly being integrated into quantum key distribution (QKD) networks, offering ultra-secure communication channels for financial institutions, governments, and critical infrastructure. The global QKD market is projected to reach $5.3 billion by 2030, with photonic hardware forming the backbone of these systems (International Data Corporation (IDC)). Additionally, quantum photonic sensors are gaining traction in fields such as medical imaging, navigation, and environmental monitoring, where their sensitivity and precision surpass classical counterparts (McKinsey & Company).

Investment hotspots in 2025 are concentrated in regions with robust photonics and semiconductor ecosystems. North America, particularly the United States, continues to attract significant venture capital and government funding, with initiatives like the National Quantum Initiative Act channeling resources into photonic hardware R&D (U.S. Department of Energy). Europe is also a key player, with the European Quantum Flagship program supporting startups and collaborations focused on integrated photonic circuits and quantum interconnects (European Commission).

Asia-Pacific, led by China and Japan, is rapidly scaling up investments in quantum photonic foundries and manufacturing capabilities, aiming to secure supply chains and accelerate commercialization (Boston Consulting Group). Notably, partnerships between academic institutions and industry leaders are fostering innovation in silicon photonics, single-photon sources, and quantum memory integration.

Looking ahead, the convergence of quantum photonic hardware with artificial intelligence and cloud platforms is expected to unlock new business models and application domains. As fabrication techniques mature and costs decline, 2025 is likely to see the first commercial deployments of photonic quantum processors and networked quantum devices, setting the stage for a new era of quantum-enabled technologies.

Challenges, Risks, and Strategic Opportunities

Quantum photonic hardware engineering faces a complex landscape of challenges and risks, but also presents significant strategic opportunities as the field matures in 2025. One of the primary technical challenges is the integration of photonic components at scale. Achieving high-fidelity quantum operations requires precise fabrication and alignment of waveguides, sources, and detectors on photonic chips. Variability in fabrication processes can lead to losses and crosstalk, impacting device performance and scalability. Companies such as PsiQuantum and Xanadu are investing heavily in advanced manufacturing techniques to address these issues, but the industry still lacks standardized processes comparable to those in classical semiconductor manufacturing.

Another significant risk is the limited availability of high-quality single-photon sources and efficient detectors. The performance of quantum photonic systems is highly dependent on the purity, indistinguishability, and efficiency of these components. While progress has been made with sources based on quantum dots and nonlinear crystals, scaling these technologies for commercial deployment remains a hurdle. Additionally, the integration of cryogenic or otherwise specialized environments for certain photonic components adds complexity and cost, potentially slowing adoption.

Supply chain constraints and the need for specialized materials, such as low-loss silicon nitride or lithium niobate, further complicate the engineering process. The global supply chain disruptions seen in recent years have highlighted the vulnerability of emerging hardware sectors to material shortages and logistical delays, as noted by IDC in their 2024 semiconductor outlook.

Despite these challenges, strategic opportunities abound. The convergence of quantum photonics with mature silicon photonics platforms offers a pathway to leverage existing CMOS infrastructure, potentially accelerating commercialization. Partnerships between quantum startups and established semiconductor foundries, such as those between Intel and quantum hardware firms, are enabling access to advanced fabrication capabilities and global distribution networks. Furthermore, the growing demand for secure communications, quantum sensing, and scalable quantum computing is driving investment and public funding, as highlighted in the OECD Quantum Technology Report 2023.

In summary, while quantum photonic hardware engineering in 2025 is fraught with technical and supply chain risks, the sector is strategically positioned to benefit from cross-industry collaboration, public investment, and the leveraging of existing photonics infrastructure to overcome these barriers and unlock new commercial applications.

Sources & References

- International Data Corporation (IDC)

- Xanadu

- European Commission

- Paul Scherrer Institute

- imec

- National Institute of Standards and Technology (NIST)

- Toshiba Corporation

- University College London

- IBM Quantum

- Rigetti Computing

- Quantinuum

- QuiX Quantum

- NTT Research

- NICT

- McKinsey & Company

- National Science Foundation

- Northrop Grumman

- State Council

- Baidu

- RIKEN

- University of Sydney

- Weizmann Institute of Science