2025 Microfluidic Organ-on-a-Chip Fabrication Industry Report: Market Dynamics, Technology Innovations, and Strategic Forecasts. Explore Key Trends, Regional Insights, and Growth Opportunities Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Microfluidic Organ-on-a-Chip Fabrication

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

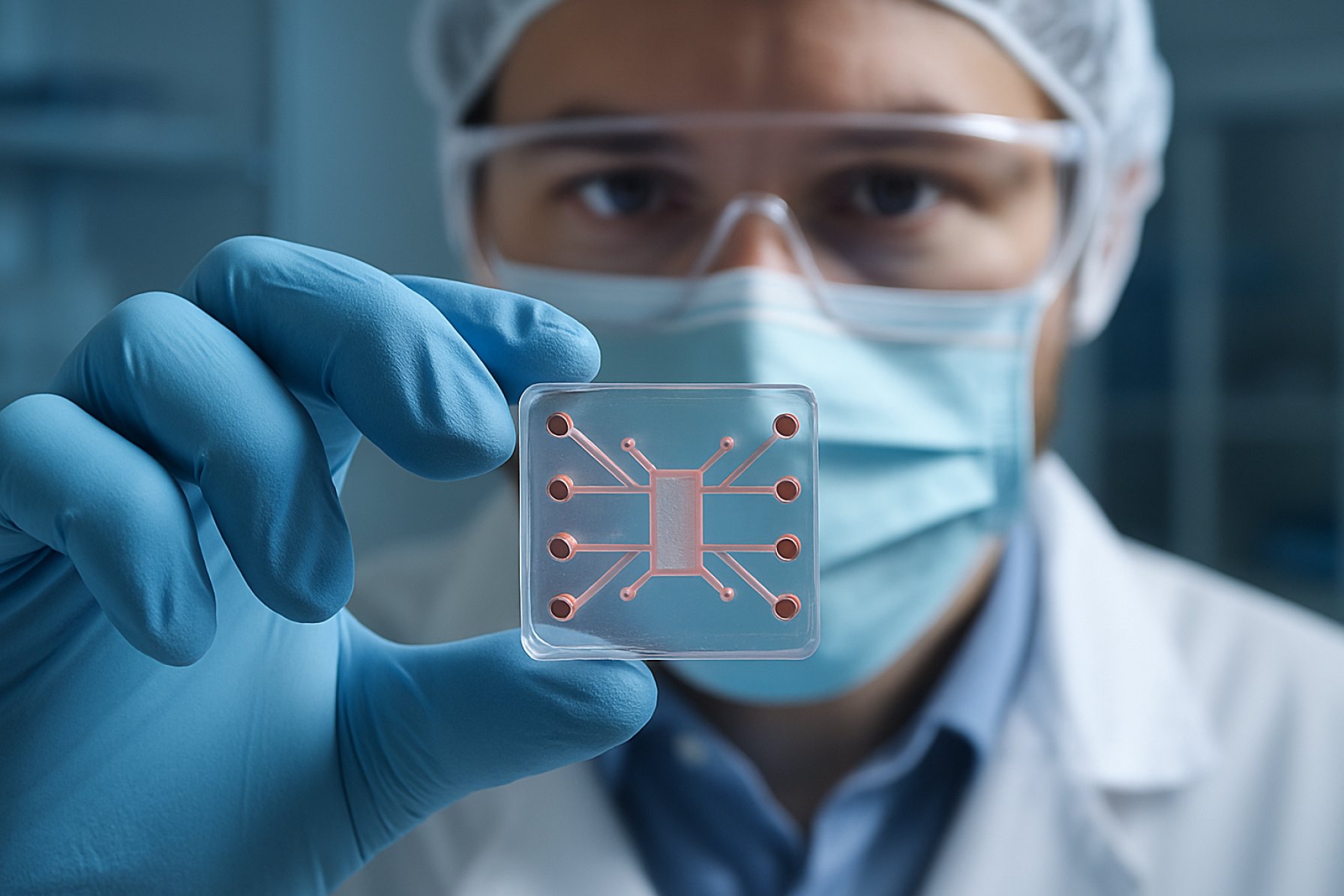

Microfluidic organ-on-a-chip (OoC) fabrication represents a transformative approach in biomedical research, drug discovery, and toxicology testing. These microengineered devices mimic the physiological functions of human organs by integrating living cells within precisely controlled microenvironments, enabling more accurate modeling of human biology compared to traditional in vitro and animal models. The global market for microfluidic organ-on-a-chip fabrication is experiencing robust growth, driven by increasing demand for predictive preclinical models, advancements in microfabrication technologies, and the push for alternatives to animal testing.

According to Grand View Research, the global organ-on-a-chip market was valued at approximately USD 103 million in 2023 and is projected to expand at a compound annual growth rate (CAGR) exceeding 30% through 2030. The microfluidic fabrication segment is a key enabler of this growth, as it allows for the creation of highly reproducible, scalable, and customizable platforms that can simulate complex tissue-tissue and organ-organ interactions. The adoption of microfluidic OoC systems is particularly strong in pharmaceutical R&D, where they are used to assess drug efficacy and toxicity with greater physiological relevance.

North America currently leads the market, supported by significant investments from both public and private sectors, a strong presence of biotechnology firms, and favorable regulatory initiatives encouraging the reduction of animal testing. Europe follows closely, with the European Union’s funding for alternatives to animal research further accelerating adoption. Asia-Pacific is emerging as a high-growth region, propelled by expanding biomedical research infrastructure and increasing collaborations between academic institutions and industry players.

Key industry participants, such as Emulate, Inc., MIMETAS, and CN Bio Innovations, are investing heavily in the development of advanced microfluidic fabrication techniques, including 3D printing, soft lithography, and injection molding. These innovations are enhancing device throughput, reproducibility, and integration with analytical tools, further broadening the application scope of organ-on-a-chip platforms.

In summary, the microfluidic organ-on-a-chip fabrication market in 2025 is characterized by rapid technological advancements, expanding end-user adoption, and a strong regulatory push for more human-relevant preclinical models. The sector is poised for continued expansion as stakeholders seek more predictive, ethical, and cost-effective solutions for biomedical research and drug development.

Key Technology Trends in Microfluidic Organ-on-a-Chip Fabrication

Microfluidic organ-on-a-chip (OoC) fabrication is undergoing rapid technological evolution, driven by the need for more physiologically relevant in vitro models in drug discovery, toxicology, and disease modeling. As of 2025, several key technology trends are shaping the landscape of OoC fabrication, enhancing both the complexity and scalability of these systems.

- Advanced Materials and 3D Printing: The adoption of novel biomaterials, such as hydrogels and biocompatible polymers, is enabling the creation of microenvironments that closely mimic native tissue properties. 3D printing technologies, including two-photon polymerization and digital light processing, are increasingly used to fabricate intricate microfluidic architectures with high precision and reproducibility. These advances allow for the integration of multiple cell types and vascular-like networks within a single chip, improving physiological relevance (Nature Reviews Materials).

- Integration of Sensors and Real-Time Monitoring: The embedding of biosensors—such as electrochemical, optical, and impedance-based sensors—directly into microfluidic chips is becoming standard. This enables continuous, real-time monitoring of key parameters like pH, oxygen, metabolites, and barrier integrity, providing dynamic insights into tissue function and drug responses (National Institutes of Health).

- Automation and High-Throughput Platforms: Automation is streamlining OoC fabrication and operation, with robotic liquid handling and microfluidic multiplexing allowing for parallelization and higher throughput. This is critical for pharmaceutical applications, where large-scale screening of compounds is required. Companies are developing modular platforms that can be customized for different organ models and experimental needs (Emulate, Inc.).

- Multi-Organ and Body-on-a-Chip Systems: There is a growing trend toward connecting multiple organ chips via microfluidic channels to simulate systemic interactions, such as metabolism and immune responses. These multi-organ platforms are advancing the study of complex pharmacokinetics and disease mechanisms, moving closer to replicating whole-body physiology in vitro (TissUse GmbH).

- Standardization and Scalability: Efforts to standardize chip designs, materials, and protocols are gaining momentum, facilitating reproducibility and regulatory acceptance. Scalable manufacturing techniques, such as injection molding and roll-to-roll processing, are being adopted to meet the growing demand for commercial and research applications (IDTechEx).

These trends collectively underscore a shift toward more robust, scalable, and physiologically relevant microfluidic organ-on-a-chip systems, positioning the technology for broader adoption in both research and industry by 2025.

Competitive Landscape and Leading Players

The competitive landscape of the microfluidic organ-on-a-chip (OoC) fabrication market in 2025 is characterized by a dynamic mix of established biotechnology firms, innovative startups, and academic spin-offs. The sector is driven by rapid technological advancements, strategic collaborations, and increasing investment from both public and private sectors. Key players are focusing on expanding their product portfolios, enhancing device scalability, and improving physiological relevance to gain a competitive edge.

Leading the market are companies such as Emulate, Inc., which has established itself as a pioneer with its Human Emulation System, widely adopted by pharmaceutical and academic researchers for drug discovery and toxicity testing. MIMETAS is another major player, recognized for its OrganoPlate® platform that enables high-throughput screening and complex tissue modeling. CN Bio Innovations has also gained significant traction, particularly in liver-on-a-chip and multi-organ systems, supported by collaborations with leading pharmaceutical companies.

Emerging companies such as TissUse GmbH and Nortis are making notable contributions, especially in multi-organ and vascularized chip models. These firms are leveraging proprietary microfluidic technologies to replicate complex human physiological responses, attracting interest from both research institutions and industry partners.

The competitive environment is further intensified by the entry of large life sciences corporations. Merck KGaA and Thermo Fisher Scientific have expanded their presence through acquisitions and partnerships, integrating organ-on-a-chip technologies into their broader portfolios of laboratory and drug development solutions.

- Strategic Collaborations: Partnerships between OoC developers and pharmaceutical companies are accelerating validation and adoption. For example, Emulate, Inc. has ongoing collaborations with Roche and Janssen to integrate OoC platforms into preclinical workflows.

- Academic-Industry Synergy: Many leading players maintain close ties with academic research, facilitating technology transfer and rapid prototyping. This synergy is crucial for innovation and early-stage validation.

- Regional Dynamics: North America and Europe dominate the market, with significant R&D funding and regulatory support. However, Asia-Pacific is emerging rapidly, driven by investments in biomedical research and government initiatives.

Overall, the microfluidic organ-on-a-chip fabrication market in 2025 is marked by intense competition, robust innovation pipelines, and a growing emphasis on scalability and standardization to meet the evolving needs of drug discovery and personalized medicine.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The microfluidic organ-on-a-chip fabrication market is poised for robust growth between 2025 and 2030, driven by accelerating adoption in pharmaceutical research, toxicology testing, and personalized medicine. According to projections by Grand View Research, the global organ-on-a-chip market is expected to register a compound annual growth rate (CAGR) of approximately 30% during this period. This surge is underpinned by increasing demand for physiologically relevant in vitro models that can replicate human organ functions more accurately than traditional cell culture or animal models.

Revenue forecasts indicate that the market, valued at around USD 100 million in 2024, could surpass USD 400 million by 2030, with microfluidic fabrication technologies accounting for a significant share of this expansion. The integration of advanced microfabrication techniques, such as soft lithography and 3D printing, is enabling the production of more complex and scalable organ-on-a-chip devices, further fueling market growth. MarketsandMarkets projects that the microfluidic segment will maintain its dominance, supported by ongoing innovations and increased funding for R&D activities.

Volume analysis suggests a parallel rise in the number of microfluidic organ-on-a-chip units produced and deployed globally. The pharmaceutical and biotechnology sectors are anticipated to be the primary end-users, accounting for over 60% of total volume demand by 2030. This is attributed to the growing emphasis on reducing drug development timelines and improving predictive accuracy for human responses. Additionally, regulatory agencies such as the U.S. Food and Drug Administration (FDA) are increasingly recognizing organ-on-a-chip data in preclinical studies, which is expected to further accelerate adoption rates.

- CAGR (2025–2030): ~30%

- Projected Market Revenue (2030): USD 400+ million

- Key Growth Drivers: Pharmaceutical R&D, regulatory acceptance, technological advancements in microfluidics

- Volume Growth: Significant increase in units, especially in North America, Europe, and Asia-Pacific

In summary, the microfluidic organ-on-a-chip fabrication market is set for exponential growth through 2030, with strong revenue and volume expansion driven by technological innovation and increasing industry acceptance.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global microfluidic organ-on-a-chip (OoC) fabrication market is experiencing robust growth, with regional dynamics shaped by research intensity, regulatory frameworks, and industry partnerships. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for market participants.

North America remains the largest market for microfluidic OoC fabrication, driven by strong investments in biomedical research, a mature biotechnology sector, and supportive regulatory initiatives. The United States, in particular, benefits from significant funding from agencies such as the National Institutes of Health and collaborations with leading pharmaceutical companies. The presence of key players and academic institutions accelerates innovation and commercialization. The region’s focus on reducing animal testing and expediting drug discovery further fuels demand for advanced OoC platforms.

Europe is characterized by a collaborative research environment and progressive regulatory policies. The European Union’s emphasis on alternative testing methods, as outlined in the Horizon Europe program, supports the adoption of organ-on-a-chip technologies. Countries such as Germany, the UK, and the Netherlands are at the forefront, with strong public-private partnerships and a growing number of startups. The region’s regulatory harmonization efforts and funding for translational research are expected to drive steady market expansion through 2025.

Asia-Pacific is emerging as a high-growth region, propelled by increasing investments in life sciences, expanding pharmaceutical manufacturing, and government initiatives to modernize healthcare research. China, Japan, and South Korea are leading the charge, with substantial funding for microfluidics and organ-on-a-chip research. The region’s large patient population and rising demand for personalized medicine create significant opportunities for market growth. However, challenges such as fragmented regulatory standards and limited access to advanced fabrication infrastructure persist.

Rest of the World (RoW) encompasses Latin America, the Middle East, and Africa, where market penetration remains nascent but is gradually increasing. Growth in these regions is supported by international collaborations, technology transfer initiatives, and rising awareness of advanced biomedical research tools. However, limited funding and infrastructure continue to constrain rapid adoption.

Overall, regional market dynamics in 2025 reflect a combination of established leadership in North America and Europe, rapid expansion in Asia-Pacific, and emerging opportunities in RoW, as highlighted by recent analyses from Grand View Research and MarketsandMarkets.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for microfluidic organ-on-a-chip (OoC) fabrication is marked by rapid technological advancements, expanding application domains, and increasing investment activity. As of 2025, the convergence of microengineering, biomaterials, and stem cell technologies is enabling the creation of more physiologically relevant and scalable OoC platforms. These innovations are expected to transform preclinical drug testing, disease modeling, and personalized medicine.

Emerging applications are particularly prominent in the pharmaceutical and biotechnology sectors. OoC systems are increasingly being adopted for high-throughput drug screening, toxicity testing, and modeling of complex human diseases such as cancer, neurodegenerative disorders, and rare genetic conditions. The ability to replicate multi-organ interactions on a single chip is also opening new avenues for studying systemic drug effects and pharmacokinetics, which are difficult to achieve with traditional in vitro or animal models. Notably, the U.S. Food and Drug Administration (FDA) has shown growing interest in integrating OoC data into regulatory submissions, signaling a shift toward broader industry acceptance and regulatory validation (U.S. Food and Drug Administration).

Investment hotspots are emerging in North America, Europe, and parts of Asia-Pacific, driven by robust R&D ecosystems and supportive government initiatives. Venture capital funding and strategic partnerships are accelerating the commercialization of OoC technologies. For instance, companies such as Emulate, Inc. and MIMETAS have secured significant investments to expand their product portfolios and global reach. According to Grand View Research, the global organ-on-a-chip market is projected to grow at a CAGR of over 30% through 2030, with microfluidic fabrication technologies being a key driver of this expansion.

- Personalized medicine: Patient-derived cells are increasingly used to fabricate chips tailored to individual genetic backgrounds, enabling precision drug testing and therapy optimization.

- Multi-organ integration: Advances in microfluidic design are facilitating the development of interconnected organ systems, supporting more comprehensive disease modeling and drug evaluation.

- Automation and scalability: The integration of robotics and AI-driven analytics is streamlining chip fabrication and data interpretation, making OoC platforms more accessible for large-scale industrial use.

In summary, 2025 is poised to be a pivotal year for microfluidic organ-on-a-chip fabrication, with emerging applications and investment hotspots shaping the next wave of innovation and commercialization in this dynamic field.

Challenges, Risks, and Strategic Opportunities

The microfluidic organ-on-a-chip (OoC) fabrication sector faces a complex landscape of challenges, risks, and strategic opportunities as it advances toward broader adoption in 2025. One of the primary challenges is the standardization of fabrication processes. The diversity of materials (such as PDMS, thermoplastics, and hydrogels) and microfabrication techniques (including soft lithography, 3D printing, and injection molding) leads to variability in device performance and reproducibility, which complicates regulatory approval and large-scale commercialization. This lack of standardization is a significant barrier for pharmaceutical companies and research institutions seeking reliable, scalable platforms for drug testing and disease modeling U.S. Food and Drug Administration.

Another risk is the integration of complex biological components, such as multiple cell types and vascularization, within microfluidic chips. Achieving physiologically relevant models that accurately mimic human organ function remains technically demanding. Issues such as cell viability, long-term culture stability, and the recreation of dynamic microenvironments are ongoing hurdles. These technical limitations can impact the predictive power of OoC systems, potentially slowing their adoption by the pharmaceutical industry Nature Biotechnology.

Intellectual property (IP) and competitive risks are also prominent. The rapid pace of innovation has led to a crowded IP landscape, with overlapping patents and potential for litigation. Startups and established players alike must navigate this environment carefully to avoid costly disputes and ensure freedom to operate World Intellectual Property Organization.

Despite these challenges, strategic opportunities abound. The growing demand for animal-free testing models, driven by regulatory shifts in the U.S. and Europe, is accelerating investment in OoC technologies. The U.S. FDA’s recent moves to accept alternative models for drug testing create a favorable environment for market expansion U.S. Food and Drug Administration. Additionally, advances in automation, sensor integration, and data analytics are enabling more robust, high-throughput OoC platforms, opening new avenues for personalized medicine and toxicology screening Grand View Research.

Strategically, partnerships between device manufacturers, pharmaceutical companies, and academic institutions are critical for overcoming technical and regulatory barriers. Collaborative efforts can accelerate the development of standardized platforms and validation protocols, positioning the industry for sustainable growth in 2025 and beyond.

Sources & References

- Grand View Research

- Emulate, Inc.

- MIMETAS

- Nature Reviews Materials

- National Institutes of Health

- TissUse GmbH

- IDTechEx

- Emulate, Inc.

- Thermo Fisher Scientific

- Roche

- Janssen

- MarketsandMarkets

- National Institutes of Health

- Horizon Europe

- World Intellectual Property Organization