Table of Contents

- Executive Summary and Industry Overview

- Current Market Size and Regional Demand Dynamics

- Key Applications: Oil & Gas, Mining, and Environmental Sectors

- Breakthroughs in Isotope Geochemical Analysis Technologies

- Leading Manufacturers and Supply Chain Developments

- Regulatory Standards and Environmental Considerations

- Emerging Markets and Growth Opportunities Through 2030

- Competitive Landscape and Strategic Collaborations

- Market Forecasts and Investment Trends (2025–2030)

- Future Outlook: Innovation, Sustainability, and Industry Challenges

- Sources & References

Executive Summary and Industry Overview

Barite isotope geochemical analysis has emerged as a critical tool in both resource exploration and environmental studies, leveraging advances in analytical techniques to provide more nuanced insights into the origin, formation, and alteration of barite deposits. As of 2025, the industry is witnessing a significant uptick in demand for isotope analysis services, driven largely by the petroleum, mining, and environmental sectors. The increasing complexity of ore genesis models and heightened regulatory requirements for environmental monitoring are propelling the adoption of sophisticated isotopic methodologies.

The integration of sulfur and oxygen isotope analysis in barite is particularly impactful in tracing fluid sources, understanding diagenetic histories, and distinguishing between hydrothermal and sedimentary origins. Companies such as www.thermofisher.com and www.perkinelmer.com are at the forefront, offering high-precision mass spectrometers and sample preparation systems specifically tailored for stable isotope ratio measurements in minerals like barite.

Recent advancements have improved both the sensitivity and throughput of barite isotope analysis. For example, multi-collector inductively coupled plasma mass spectrometry (MC-ICP-MS) and laser ablation techniques now allow for in situ analysis with minimal sample destruction, supporting high-resolution spatial mapping of isotopic compositions. Laboratories using such technologies, including www.sgs.com and www.bureauveritas.com, are expanding their analytical service portfolios to accommodate the growing requirements of mining companies exploring for new barite resources and petroleum companies seeking to mitigate scale formation in reservoirs.

On the regulatory front, the increasing emphasis on traceability and environmental stewardship is pushing industry players to adopt isotope geochemical analysis for provenance studies and contamination assessments. For instance, barite used in drilling mud must now be scrutinized for potential environmental impacts, with isotopic signatures serving as a reliable tool for source verification and pollution tracking.

Looking ahead to the next few years, the barite isotope analysis sector is poised for further growth, buoyed by ongoing investments in analytical instrumentation and the expansion of laboratory capabilities. Strategic collaborations between equipment manufacturers and analytical service providers are anticipated to drive innovation, reduce costs, and improve data turnaround times. With global exploration budgets stabilizing and environmental regulations tightening, the outlook remains positive for the continued adoption and evolution of barite isotope geochemical analysis across multiple industries.

Current Market Size and Regional Demand Dynamics

Barite isotope geochemical analysis is an increasingly essential tool for understanding sedimentary processes, tracing fluid migration, and characterizing ore genesis in both academic and industrial geoscience sectors. In 2025, the global market for this specialized analytical service is experiencing moderate but steady expansion, primarily driven by demand from the oil and gas industry, environmental monitoring, and academic research institutions. North America, particularly the United States, remains a significant center for barite isotope analysis due to ongoing hydrocarbon exploration and production, as well as robust funding for geoscientific research. Major service providers with advanced analytical capabilities, such as www.alsglobal.com and www.sgs.com, continue to expand their laboratory networks and invest in high-precision mass spectrometry technologies to meet growing client demand.

In Europe, regional demand is concentrated around countries with active mining sectors and strong environmental regulations, such as Germany, the United Kingdom, and Scandinavia. Institutions like www.bgs.ac.uk play a pivotal role in research-driven applications and collaborative industry projects. Meanwhile, Asia-Pacific is emerging as a high-growth region, fueled by expanding mineral exploration in China, India, and Australia. Large mining companies and geological surveys in these countries are increasingly investing in barite isotope geochemical analysis to enhance ore deposit modeling and ensure compliance with environmental standards.

The Middle East, with its vast hydrocarbon reserves, also represents a growing market, particularly for tracing sulfate sources and understanding diagenetic processes in reservoir rocks. www.sgs.com and regional laboratories are scaling up their capabilities in response to exploration activity and government-backed research initiatives. Latin America and Africa, though smaller in current market share, are projected to see increased demand over the next few years as mining and energy projects ramp up and regulatory frameworks mature.

Looking ahead to the next few years, the continued integration of barite isotope geochemical analysis with multi-isotope and multi-element analytical suites is expected to drive further market growth. Investments in automation and digital data handling by leading laboratories will likely enhance throughput and data quality, making these analyses more accessible and cost-effective across regions. Additionally, the increasing emphasis on sustainable mining and environmental stewardship is anticipated to boost demand for barite isotope studies, particularly for provenance tracing and contamination assessment in sensitive ecosystems.

Key Applications: Oil & Gas, Mining, and Environmental Sectors

Barite isotope geochemical analysis is emerging as a critical technique across several industrial sectors, particularly oil & gas, mining, and environmental science. Utilizing stable isotopes of sulfur, oxygen, and strontium in barite (BaSO4), this analytical approach provides valuable insights into the genesis, migration pathways, and environmental impacts of barite deposits and associated fluids. As of 2025, advancements in analytical instrumentation and sample preparation are enabling more precise, rapid, and reliable isotope ratio measurements, supporting a range of applications.

- Oil & Gas Sector: In oilfield operations, barite is widely used as a weighting agent in drilling fluids. Isotope geochemical analysis is increasingly employed to distinguish between naturally occurring barite deposits and those formed as scale within production systems. This differentiation helps operators such as www.slb.com and www.halliburton.com optimize scale management, mitigate formation damage, and ensure regulatory compliance. By tracing the isotopic signatures, geoscientists can also assess the origin of formation waters, aiding reservoir characterization and enhanced oil recovery strategies.

- Mining Industry: The mining sector leverages barite isotope analysis to improve exploration models and ore genesis studies. Companies like www.apexmines.com are increasingly integrating isotope data to discern hydrothermal processes and fluid sources responsible for barite mineralization. This information refines exploration drilling targets and supports resource estimation, particularly as demand for high-purity barite grows in both industrial and technological applications.

- Environmental Applications: Environmental monitoring agencies and consultancies are adopting barite isotope geochemistry to track anthropogenic impacts, especially in regions affected by mining or fossil fuel extraction. For example, isotopic ratios can reveal barite precipitation associated with acid mine drainage or industrial wastewater, supporting remediation efforts and compliance with environmental standards set by organizations such as the www.epa.gov.

Looking forward, the next few years are expected to witness wider adoption of barite isotope geochemical analysis as analytical costs decrease and automation improves. Integration with other geochemical and isotopic tracers—such as lithium, lead, and rare earth elements—will further enhance source discrimination and environmental tracing capabilities. Companies are also investing in digital platforms to manage and interpret complex isotopic datasets, enabling real-time decision-making in field and laboratory settings. As regulatory scrutiny intensifies and sustainability becomes a key driver, the role of barite isotope analysis in ensuring responsible resource development and environmental stewardship is set to expand significantly by the end of the decade.

Breakthroughs in Isotope Geochemical Analysis Technologies

Barite (BaSO4) isotope geochemical analysis has experienced significant technological progress in recent years, with 2025 marking a period of rapid innovation. Historically, barite’s stable sulfur (δ34S), oxygen (δ18O), and barium (δ138Ba) isotope signatures have been essential in reconstructing ancient ocean chemistry, hydrothermal processes, and biogeochemical cycles. The current era is characterized by the integration of next-generation mass spectrometry, novel microanalytical techniques, and advanced sample preparation systems, each contributing to improved data precision and spatial resolution.

Recent advancements are anchored by the widespread adoption of multi-collector inductively coupled plasma mass spectrometry (MC-ICP-MS), which enables high-sensitivity and high-accuracy isotope ratio measurements even in microscale barite samples. Companies such as www.thermofisher.com and www.spectro.com have introduced new MC-ICP-MS platforms capable of sub-permil precision for barium isotopes, a critical factor for environmental and geochemical tracing. Additionally, the evolution of laser ablation sample introduction systems, pioneered by firms like www.teledynecetac.com, allows for in situ, high-resolution mapping of isotopic heterogeneities within single barite grains, reducing contamination risk and sample consumption.

On the laboratory automation front, companies such as www.perkinelmer.com have developed automated digestion and chromatographic separation systems tailored for barite matrices. These streamline the typically labor-intensive pre-analysis procedures, ensuring higher throughput and reproducibility—an essential feature as demand rises for large-scale environmental and oilfield studies. Furthermore, the integration of artificial intelligence for data reduction and quality control, as pioneered by www.agilent.com, is facilitating faster turnaround times and minimizing operator-dependent variability.

Looking ahead, the next few years will likely see the commercialization of ultra-high spatial resolution isotope imaging, with prototype secondary ion mass spectrometry (SIMS) and nanoSIMS instruments now being tested by www.cameca.com. These technologies promise to resolve micron-scale isotopic zonation, offering new insights into the growth history and post-depositional alteration of barite in both sedimentary and hydrothermal settings.

As the barite isotope analysis community continues to push the boundaries of precision and throughput, collaborations between instrument manufacturers and geochemical laboratories are expected to intensify. The ongoing drive for more robust, field-deployable isotope systems—currently under development by several industry leaders—suggests that, by the end of this decade, isotope geochemistry may become an even more routine and indispensable tool for environmental monitoring, resource exploration, and geological research.

Leading Manufacturers and Supply Chain Developments

Barite isotope geochemical analysis has emerged as a crucial technique in disciplines ranging from petroleum exploration to environmental science, and its supply chain is closely linked to global barite production and high-precision analytical equipment. As of 2025, several leading manufacturers and suppliers underpin the market, with ongoing developments aimed at improving analytical accuracy, throughput, and supply resilience.

The supply chain for barite isotope geochemical analysis begins with the mining and processing of high-purity barite (barium sulfate). Major producers like www.chinabarytes.com in China and www.halliburton.com in the United States supply refined barite suitable for isotopic studies, providing consistent feedstock for research and industrial applications. Recent years have seen these companies enhance their ore beneficiation and purity controls, ensuring minimal isotopic contamination—a critical factor for precise geochemical analysis.

On the instrumentation side, leading manufacturers such as www.thermofisher.com and www.spectromat.com continue to innovate with isotope ratio mass spectrometers tailored for sulfur and oxygen isotope analysis in barite samples. In 2024–2025, Thermo Fisher introduced next-generation IRMS systems with improved ion optics and automation, reducing analysis time and operator intervention. These developments address the growing demand for high-throughput, reproducible isotope data from the oil & gas, mining, and environmental remediation sectors.

Supply chain resilience remains a focal point following pandemic-era disruptions and geopolitical tensions affecting mineral exports. Companies like www.excalibar.com have diversified their sourcing and expanded processing capacities in North America, providing an alternative to Asian barite supplies and supporting uninterrupted research workflows. Moreover, some suppliers are partnering with analytical service providers and universities to ensure a stable pipeline of ultra-high-purity barite for advanced geochemical applications.

Looking ahead to 2025 and beyond, the outlook is for further integration across the barite-to-analysis supply chain. Strategic investments in domestic barite mining and advanced analytical laboratories are expected, particularly in the U.S. and Europe, to strengthen supply chain autonomy and meet the rising regulatory standards for data traceability and reproducibility in isotope geochemistry. Industry bodies such as the www.bariteworld.com are forecasting continued growth in barite isotope analysis, driven by energy transition projects, carbon capture initiatives, and new frontiers in earth system science.

Regulatory Standards and Environmental Considerations

Barite isotope geochemical analysis has gained significant prominence in recent years due to heightened regulatory scrutiny and the growing need for environmental accountability in resource extraction and utilization. As of 2025, government agencies and industry organizations are increasingly mandating rigorous standards for the sourcing and processing of barite, driven by its widespread use in sectors such as oil and gas drilling, where its traceability and purity are critical.

One of the primary regulatory developments in 2025 is the implementation of more stringent environmental monitoring protocols for barite mining and processing operations. Regulatory bodies, including the www.epa.gov and the www.europarl.europa.eu, have advocated for the use of stable isotope analysis to trace the geochemical fingerprint of barite. This analytical approach helps distinguish between natural and anthropogenic sources of sulfate contamination, which is essential for environmental impact assessments and compliance verification.

The adoption of isotope geochemical analysis is also being driven by industry-specific standards. For example, the www.api.org continues to refine its standards for barite used in drilling fluids, with a particular focus on purity and trace element content. Isotopic analysis enables suppliers and end-users to verify the provenance and processing history of barite, reducing the risk of introducing contaminants that could compromise drilling operations or cause environmental harm.

On the environmental front, mining companies are increasingly leveraging isotope analysis to demonstrate responsible stewardship and to comply with new requirements for lifecycle assessments. Leading producers such as www.halliburton.com are incorporating isotope data into their supply chain transparency initiatives, responding to stakeholder demands for sustainable sourcing practices. Similarly, environmental agencies are utilizing geochemical signatures to monitor and remediate legacy mining sites, ensuring that sulfate runoff and other pollutants are traced accurately to their sources.

Looking ahead, regulatory frameworks are expected to evolve further, with international cooperation on harmonizing standards for barite isotope analysis. Initiatives by organizations like the www.iso.org are underway to establish global benchmarks for analytical methodologies. As these standards mature, laboratories and industry participants will need to invest in advanced instrumentation and training to maintain compliance and support environmental objectives. The next several years will see continued integration of isotope geochemistry into both regulatory oversight and environmental management practices, solidifying its role as a cornerstone of responsible barite supply chains.

Emerging Markets and Growth Opportunities Through 2030

Barite isotope geochemical analysis is gaining significant momentum in emerging markets, driven by advancements in analytical technology, increased demand for environmental monitoring, and the expansion of resource exploration activities. As of 2025, the market for barite isotope analysis is expanding beyond traditional strongholds in North America and Europe, with notable growth in regions such as Asia-Pacific, Latin America, and parts of Africa.

A key growth driver is the increasing application of barite isotope studies in mineral exploration and hydrocarbon prospecting. Barite’s isotopic signatures, particularly of sulfur and oxygen, are critical for tracing fluid pathways and understanding ore genesis in complex geological environments. Resource-rich nations including China and India are ramping up investments in advanced geochemical laboratories, aiming to reduce reliance on imported analytical services and bolster domestic research capabilities. For instance, www.cgs.gov.cn has expanded its suite of isotope analysis tools to support both environmental and mineral resource studies.

Environmental monitoring is another emerging application, with governments and industry increasingly relying on barite isotope analysis to trace pollutants and assess anthropogenic impacts on groundwater and surface water systems. In Latin America, recent collaborations between national geological services and academic institutions have led to the establishment of new barite isotope laboratories, particularly in countries such as Brazil and Chile, where mining and water resource management are critical sectors (www.cprm.gov.br).

The outlook through 2030 suggests robust growth opportunities for companies supplying mass spectrometry equipment, laboratory automation, and reagents tailored for stable isotope analysis. Leading manufacturers such as www.thermofisher.com and www.perkinelmer.com are responding with more accessible, high-throughput isotope ratio mass spectrometers, lowering cost barriers for new entrants in emerging markets.

- Data digitalization: There is a parallel trend toward cloud-based data management platforms, enabling collaborative international research and opening opportunities for data analytics providers.

- Capacity building: National funding programs are supporting workforce development in isotope geochemistry, creating a pipeline of skilled analysts and fostering regional centers of excellence.

- Regulatory support: Enhanced regulatory frameworks around mining and water quality are expected to further incentivize the adoption of barite isotope analysis in environmental compliance and reporting.

In summary, the period from 2025 to 2030 is poised to bring substantial expansion and diversification in the barite isotope geochemical analysis market, with emerging economies at the forefront of growth and innovation. Continued technology transfer, infrastructural investments, and regulatory alignment will be decisive factors shaping the trajectory of this dynamic sector.

Competitive Landscape and Strategic Collaborations

The competitive landscape for barite isotope geochemical analysis is evolving rapidly as demand grows across mineral exploration, environmental monitoring, and energy sectors. Key players in this niche analytical field include specialized laboratories, instrumentation manufacturers, and research organizations, many of whom are pursuing strategic collaborations to advance technical capabilities and expand global reach.

Instrument manufacturers such as www.thermofisher.com and www.agilent.com continue to refine mass spectrometry platforms—particularly multi-collector inductively coupled plasma mass spectrometry (MC-ICP-MS)—to improve the precision and throughput of barite isotope measurements. These advances are being integrated into laboratory workflows worldwide, underpinning competitive differentiation for analytical service providers.

Independent laboratories and contract research organizations are also expanding their barite isotope service portfolios. For instance, www.sgs.com has incorporated advanced sulfur and oxygen isotope analysis for barite into their mineral exploration services, targeting the mining and oil & gas sectors where isotopic fingerprinting supports resource characterization and provenance studies. Similarly, www.bureauveritas.com is investing in geochemical laboratories with enhanced capacity for stable isotope analysis, positioning themselves to serve major exploration projects globally.

Strategic collaborations are a hallmark of the current landscape. Laboratory networks such as www.eurofins.com are partnering with universities and government geoscience agencies to standardize analytical protocols and develop new reference materials. This not only ensures data comparability but also accelerates the adoption of advanced isotope methods in regulatory and industrial contexts.

Joint ventures between equipment manufacturers and service providers are expected to intensify through 2025 and beyond. For example, collaborations focused on automating sample preparation for barite isotope analysis are underway, aiming to reduce turnaround times and minimize analytical errors—a key competitive advantage for contract laboratories.

Looking ahead, the sector is poised for consolidation as well as innovation. Companies with integrated analytical platforms and a robust network of strategic alliances are likely to capture greater market share. Cross-sector partnerships, particularly those bridging mining, environmental monitoring, and energy geochemistry, will shape the future competitive landscape. As regulatory scrutiny and demand for traceability increase, stakeholders who can offer reliable, high-throughput, and standardized barite isotope geochemical services will be best positioned for growth.

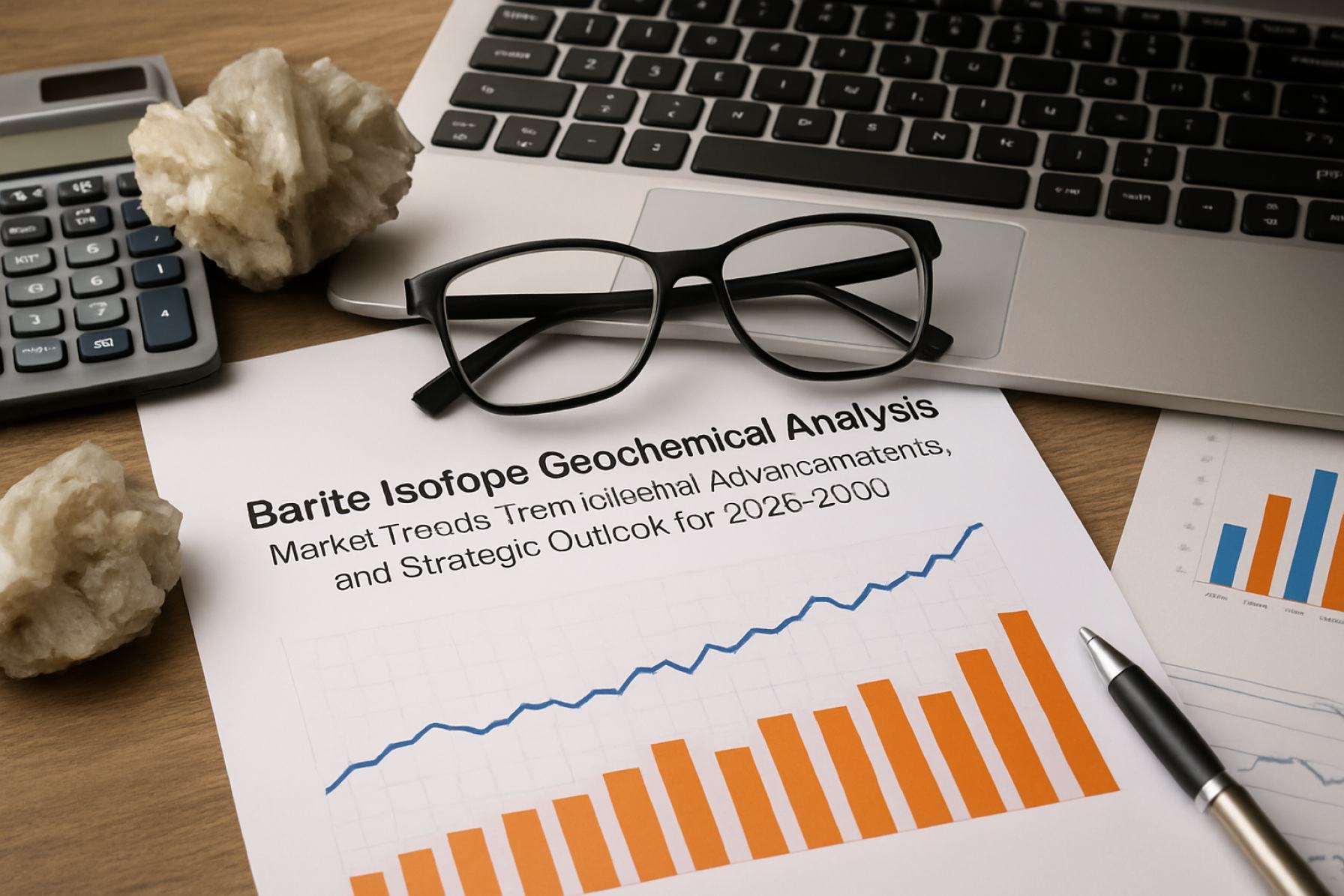

Market Forecasts and Investment Trends (2025–2030)

The period from 2025 to 2030 is expected to witness accelerated growth and innovation in the field of barite isotope geochemical analysis, driven by advances in analytical instrumentation, increased demand from the energy sector, and a surge in environmental and resource exploration applications. As oil and gas exploration continues to target deeper and more complex reservoirs, the need for precise geochemical fingerprinting of barite, particularly through isotopic signatures (such as δ34S and δ18O), is projected to rise. This trend is reinforced by major service providers and mining companies investing in upgrading laboratory capabilities and field-deployable equipment.

Recent statements from leading laboratory solution providers, such as www.thermofisher.com and www.perkinelmer.com, indicate ongoing development of next-generation mass spectrometry platforms tailored for isotope ratio analysis. These improvements are set to reduce sample preparation times and increase throughput, allowing for more extensive basin-scale or mine-site studies over the next five years. Additionally, the integration of automated data processing and cloud-based laboratory management systems is anticipated to streamline geochemical workflows and facilitate collaboration between laboratories and exploration teams.

In terms of investment, mining companies such as www.halliburton.com and www.schlum berger.com are allocating larger budgets toward geochemical and isotopic profiling, recognizing its value in provenance studies, resource estimation, and process optimization. Furthermore, environmental monitoring agencies and academic institutions are expected to increase funding for barite isotope analysis to track anthropogenic sulfate sources, assess groundwater contamination, and reconstruct paleoenvironments.

By 2030, the global market for barite isotope geochemical analysis is forecasted to experience steady growth, underpinned by increasing adoption in Asia-Pacific and Latin America, where exploration and environmental projects are expanding. Partnerships between instrument manufacturers, mining firms, and research organizations are likely to accelerate technology transfer, training, and best practice dissemination.

Overall, the outlook for barite isotope geochemical analysis from 2025 to 2030 is one of robust expansion, technological advancement, and diversification of applications. Stakeholders across the supply chain are set to benefit from enhanced analytical precision, broader service offerings, and evolving regulatory frameworks that prioritize environmental stewardship and resource sustainability.

Future Outlook: Innovation, Sustainability, and Industry Challenges

The future of barite isotope geochemical analysis is poised for significant advancement as demand for more precise, sustainable, and innovative analytical techniques grows across sectors such as oil and gas exploration, environmental monitoring, and geoscientific research. In 2025 and the coming years, several key trends and challenges are shaping the industry’s trajectory.

One major area of innovation is the refinement of analytical methods for isotopic measurement. Laboratories are increasingly adopting multi-collector inductively coupled plasma mass spectrometry (MC-ICP-MS) for more accurate and high-throughput barite isotope (notably δ34S and δ18O) analyses. For example, leading instrument manufacturers like www.thermofisher.com and www.agilent.com are expanding their offerings of high-sensitivity, low-background mass spectrometers tailored to trace-level isotopic studies. These advancements are expected to enhance the resolution of paleoenvironmental reconstructions and ore deposit tracing.

Sustainability is another emerging focal point. As environmental regulations tighten globally, there is increased emphasis on reducing the ecological footprint of sample preparation and analysis. Laboratories are adopting greener protocols—such as minimizing reagent use and employing closed-loop water systems—to limit hazardous waste and energy consumption. Organizations including the www.usgs.gov are actively working on best-practice guidelines for sustainable geochemical analysis, which are anticipated to be further developed and adopted industry-wide in the next few years.

At the same time, the industry faces several challenges. The scarcity of high-purity barite reference materials for isotopic calibration remains a bottleneck, constraining analytical consistency across laboratories. Efforts to synthesize and certify new reference standards are ongoing, with collaboration between research institutions and suppliers such as www.inorganicventures.com. Additionally, the cost of advanced analytical equipment and the need for specialized technical expertise may limit broader adoption, particularly in developing regions.

Looking ahead, the integration of artificial intelligence and machine learning into data interpretation is expected to accelerate. These technologies promise to streamline the analysis of large isotopic datasets and reveal subtle geochemical trends, supporting faster decision-making in resource exploration and environmental assessment. Overall, the outlook for barite isotope geochemical analysis in 2025 and beyond is characterized by technological innovation, a shift toward sustainability, and ongoing efforts to overcome standardization and accessibility challenges.

Sources & References

- www.thermofisher.com

- www.perkinelmer.com

- www.sgs.com

- www.alsglobal.com

- www.bgs.ac.uk

- www.slb.com

- www.halliburton.com

- www.apexmines.com

- www.spectro.com

- www.teledynecetac.com

- www.cameca.com

- www.spectromat.com

- www.bariteworld.com

- www.europarl.europa.eu

- www.api.org

- www.iso.org

- www.cgs.gov.cn