Satellite TV Secrets Unveiled: Exploring Origins, Breakthroughs, and the Next Era of Television

- Satellite TV Market Landscape: Scope and Dynamics

- Emerging Technologies Shaping Satellite Television

- Key Players and Competitive Strategies in Satellite TV

- Projected Growth and Market Expansion Insights

- Regional Perspectives: Satellite TV Adoption and Trends

- What Lies Ahead: The Future of Satellite Television

- Navigating Challenges and Seizing Opportunities in Satellite TV

- Sources & References

“Overview of Drone Laws in India (2025) India has established a comprehensive regulatory framework for civilian drone operations as of 2025.” (source)

Satellite TV Market Landscape: Scope and Dynamics

The satellite TV market has evolved dramatically since its inception, transforming from a niche technology into a global entertainment powerhouse. The origins of satellite television date back to the 1960s, when the first communications satellites, such as Telstar and Syncom, enabled the transmission of television signals across continents. By the 1980s, the proliferation of direct-to-home (DTH) satellite dishes brought multi-channel TV to millions, bypassing traditional terrestrial and cable infrastructure (Britannica).

Today, the satellite TV market is a multi-billion dollar industry. According to a 2023 report, the global satellite TV market was valued at approximately $92.7 billion and is projected to reach $110.5 billion by 2028, growing at a CAGR of 3.6% (IMARC Group). Major players include DISH Network, DirecTV (AT&T), Sky Group, and Canal+, each leveraging advanced satellite constellations to deliver high-definition and ultra-high-definition content to subscribers worldwide.

The dynamics of the market are shaped by several key factors:

- Technological Advancements: The shift from analog to digital broadcasting, the adoption of high-throughput satellites (HTS), and the integration of hybrid satellite-IP solutions have enhanced content quality and expanded service offerings (SES).

- Emerging Markets: Satellite TV remains vital in regions with limited broadband infrastructure, such as parts of Africa, Asia, and Latin America, where it provides access to information and entertainment for underserved populations (Statista).

- Competitive Pressures: The rise of over-the-top (OTT) streaming services like Netflix and Amazon Prime Video has intensified competition, prompting satellite TV providers to innovate with bundled services, interactive features, and on-demand content (Grand View Research).

- Regulatory and Spectrum Challenges: The allocation of satellite spectrum and evolving regulatory frameworks continue to influence market dynamics and investment decisions.

Looking ahead, the future of satellite TV will likely be defined by convergence with internet-based platforms, the deployment of next-generation satellites (such as low-Earth orbit constellations), and the ongoing quest to deliver seamless, high-quality viewing experiences to a global audience.

Emerging Technologies Shaping Satellite Television

Satellite television has undergone a remarkable transformation since its inception, evolving from a niche technology into a global broadcasting powerhouse. The journey began in the 1960s with the launch of the first communication satellites, such as Telstar and Syncom, which enabled the transmission of television signals across continents (NASA). These early satellites laid the groundwork for the direct-to-home (DTH) satellite TV services that would emerge decades later.

Today, satellite TV is being reshaped by a wave of emerging technologies that promise to redefine how content is delivered and consumed. Key innovations include:

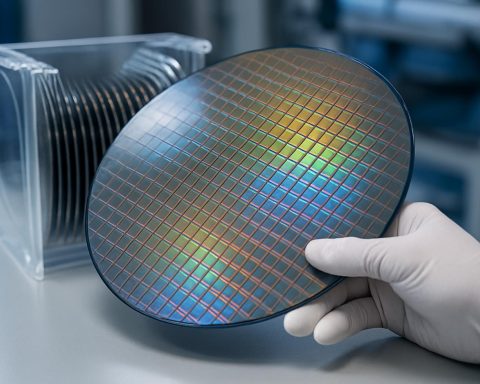

- High Throughput Satellites (HTS): Modern satellites, such as those using Ka-band frequencies, offer dramatically increased bandwidth and data rates. This enables the delivery of ultra-high-definition (UHD) and 4K content to viewers, enhancing picture quality and supporting interactive services (SES).

- Low Earth Orbit (LEO) Constellations: Companies like SpaceX (Starlink) and OneWeb are deploying LEO satellite networks that reduce latency and improve signal reliability. While primarily aimed at broadband, these networks are poised to support next-generation satellite TV and hybrid broadcast-broadband models (BBC).

- IP-Based Broadcasting: The integration of Internet Protocol (IP) technology allows satellite TV providers to offer on-demand content, cloud DVR, and personalized viewing experiences. This convergence of satellite and streaming blurs the line between traditional TV and OTT platforms (Digital TV Europe).

- Advanced Compression Standards: The adoption of HEVC (H.265) and emerging codecs enables more efficient use of satellite bandwidth, allowing broadcasters to transmit more channels and higher-quality video without increasing costs (Streaming Media).

Looking ahead, the future of satellite television will likely be defined by seamless integration with internet services, AI-driven content recommendations, and immersive formats such as 8K and virtual reality. As these technologies mature, satellite TV is set to remain a vital, innovative force in the global media landscape.

Key Players and Competitive Strategies in Satellite TV

Satellite TV has evolved from a niche technology into a global entertainment powerhouse, driven by fierce competition among industry leaders and innovative strategies. The sector’s origins trace back to the 1960s, when the first commercial communications satellite, Telstar, enabled transatlantic television broadcasts. Since then, satellite TV has transformed how content is delivered, especially in regions where terrestrial infrastructure is limited.

Key Players

- DIRECTV: As one of the largest satellite TV providers in the United States, DIRECTV boasts millions of subscribers and a broad content portfolio, including exclusive sports packages and 4K programming.

- DISH Network: Competing closely with DIRECTV, DISH Network differentiates itself with flexible packages, advanced DVR technology, and a focus on rural markets underserved by cable.

- Sky Group: Dominant in Europe, Sky offers satellite TV, broadband, and streaming services, leveraging its parent company Comcast’s resources to expand its content and technology offerings.

- Tata Play (formerly Tata Sky): A leader in India, Tata Play has capitalized on the country’s vast geography and growing middle class, providing affordable packages and regional content.

- Nilesat: Serving the Middle East and North Africa, Nilesat delivers hundreds of free-to-air and pay-TV channels, catering to diverse linguistic and cultural audiences.

Competitive Strategies

- Content Exclusivity: Providers secure exclusive rights to premium sports, movies, and original programming to attract and retain subscribers. For example, DIRECTV’s NFL Sunday Ticket has been a major draw (CNBC).

- Technological Innovation: Companies invest in advanced set-top boxes, 4K/UHD broadcasts, and hybrid satellite-streaming solutions to enhance user experience and compete with OTT platforms (Digital TV Europe).

- Market Expansion: Emerging markets remain a growth focus, with providers tailoring packages to local languages and preferences, and leveraging satellite’s reach to serve remote areas (Statista).

- Bundling and Partnerships: Satellite TV operators increasingly bundle services with broadband, mobile, and streaming, forming alliances to offer integrated entertainment solutions (Fierce Video).

As the industry faces challenges from streaming giants, satellite TV’s future will hinge on its ability to innovate, localize, and integrate with digital platforms, ensuring its relevance in the evolving television landscape.

Projected Growth and Market Expansion Insights

Satellite TV has evolved dramatically since its inception, transforming from a niche technology into a global broadcasting powerhouse. The industry’s origins trace back to the 1960s, when the first communications satellites enabled television signals to be transmitted across continents. Today, satellite TV remains a vital component of the global media landscape, serving over 1.5 billion households worldwide (Statista).

Looking ahead, the satellite TV market is projected to experience steady growth, despite increasing competition from streaming services. According to a recent report, the global satellite TV market was valued at approximately $126.2 billion in 2023 and is expected to reach $150.4 billion by 2028, growing at a CAGR of 3.6% (MarketsandMarkets). This expansion is driven by several key factors:

- Emerging Markets: Rapid urbanization and rising disposable incomes in Asia-Pacific, Africa, and Latin America are fueling demand for satellite TV, especially in regions with limited cable infrastructure.

- Technological Advancements: The deployment of high-throughput satellites (HTS) and the integration of 4K/8K ultra-high-definition content are enhancing viewing experiences and attracting new subscribers (SES).

- Hybrid Service Models: Providers are increasingly offering bundled packages that combine satellite TV with broadband and streaming services, appealing to a broader customer base.

Despite these positive trends, the industry faces challenges from the rapid adoption of over-the-top (OTT) platforms and changing consumer preferences. However, satellite TV’s unique ability to deliver reliable, high-quality content to remote and underserved areas ensures its continued relevance. Innovations such as interactive TV, cloud-based DVRs, and integration with smart home devices are expected to further bolster market growth (Grand View Research).

In summary, while the satellite TV sector is navigating a dynamic and competitive environment, its adaptability and technological advancements position it for sustained expansion. As the industry unveils new “secrets” in content delivery and user experience, satellite TV is poised to remain a key player in the future of television.

Regional Perspectives: Satellite TV Adoption and Trends

Satellite TV has undergone a remarkable transformation since its inception, evolving from a niche technology to a mainstream entertainment medium with global reach. The journey began in the 1960s, when the first communications satellites, such as Telstar and Syncom, enabled the transmission of television signals across continents (NASA). Early satellite TV required large, expensive dishes and was primarily used by broadcasters and institutions. However, the 1980s saw the advent of direct-to-home (DTH) satellite services, making satellite TV accessible to households worldwide.

Today, satellite TV remains a vital component of the global television landscape, especially in regions where terrestrial infrastructure is limited. According to the SES Satellite Monitor 2023, satellite TV reaches over 1.1 billion people globally, with particularly high penetration in Africa, the Middle East, and parts of Asia-Pacific. In Europe, satellite TV continues to serve millions, although the rise of broadband and streaming services has led to a gradual decline in some Western markets.

- North America: The U.S. and Canada have seen a steady decrease in satellite TV subscriptions, with major providers like DirecTV and DISH Network losing millions of subscribers due to cord-cutting and the proliferation of streaming platforms (Leichtman Research Group).

- Europe: While Western Europe experiences similar trends, Eastern Europe and rural areas still rely heavily on satellite TV for access to diverse content and international channels (Digital TV Europe).

- Asia-Pacific: Rapid urbanization and economic growth have fueled satellite TV adoption, particularly in India and Southeast Asia, where DTH platforms like Tata Play and Astro Malaysia serve tens of millions of subscribers (Statista).

- Africa & Middle East: Satellite TV is often the primary means of television access, with providers such as MultiChoice (DStv) and beIN serving vast, diverse audiences (Balancing Act Africa).

Looking ahead, the future of satellite TV is intertwined with technological innovation. The integration of high-throughput satellites, hybrid satellite-IP services, and 4K/8K broadcasting promises to enhance content delivery and user experience. While streaming continues to disrupt traditional models, satellite TV’s ability to reach remote and underserved regions ensures its ongoing relevance in the evolving media ecosystem.

What Lies Ahead: The Future of Satellite Television

Satellite television has undergone a remarkable transformation since its inception, evolving from a niche technology into a global entertainment powerhouse. The journey began in the 1960s with the launch of the first communication satellites, such as Telstar and Syncom, which enabled the transmission of television signals across continents. By the 1980s and 1990s, satellite TV became more accessible to consumers, thanks to the proliferation of direct-to-home (DTH) services and the miniaturization of satellite dishes (Encyclopedia Britannica).

Today, satellite TV remains a vital component of the global media landscape, serving over 1.5 billion households worldwide (Statista). Its ability to deliver high-quality content to remote and underserved regions gives it a unique advantage over terrestrial and cable networks. However, the industry faces mounting challenges from the rapid rise of internet-based streaming platforms, which offer on-demand content and personalized viewing experiences.

- Technological Advancements: The future of satellite TV is closely tied to innovations such as High Throughput Satellites (HTS), which dramatically increase data capacity and enable ultra-high-definition (UHD) broadcasts. Companies like SES and Eutelsat are investing in next-generation satellites to support 4K and even 8K content delivery (SES).

- Hybrid Models: To stay competitive, satellite TV providers are embracing hybrid models that integrate satellite delivery with broadband internet. This approach allows for interactive features, catch-up TV, and seamless streaming, bridging the gap between traditional broadcasting and digital consumption (Eutelsat).

- Global Connectivity: Satellite TV is poised to play a crucial role in bridging the digital divide, especially in rural and developing regions where terrestrial infrastructure is lacking. Initiatives like low Earth orbit (LEO) satellite constellations promise to enhance both television and broadband access worldwide (SpaceX Starlink).

As the media landscape continues to evolve, satellite television is adapting by leveraging its space-age origins and embracing cutting-edge technologies. While the competition from streaming services is fierce, satellite TV’s unique strengths—global reach, reliability, and technological innovation—ensure it will remain a key player in the future of television.

Navigating Challenges and Seizing Opportunities in Satellite TV

Satellite TV has undergone a remarkable transformation since its inception, evolving from a niche technology into a global entertainment powerhouse. Understanding its journey and future prospects is crucial for industry stakeholders and consumers alike.

Space-Age Origins

- The first commercial communications satellite, Telstar, was launched in 1962, enabling transatlantic television broadcasts and laying the groundwork for satellite TV.

- By the 1980s, direct-to-home (DTH) satellite TV emerged, allowing households to receive signals via small dishes, bypassing terrestrial infrastructure (Britannica).

Current Landscape and Challenges

- As of 2023, satellite TV serves over 200 million households worldwide, with major providers like DirecTV and DISH Network in the U.S. reporting 12.4 million and 7.4 million subscribers, respectively.

- The industry faces stiff competition from streaming services, with global OTT video revenue projected to reach $316 billion by 2027 (Statista).

- Rural and remote areas remain reliant on satellite TV due to limited broadband access, highlighting its ongoing relevance (ITU).

Opportunities and the Future

- Hybrid models are emerging, with satellite providers integrating streaming platforms and on-demand content to retain subscribers (Digital TV Europe).

- Advancements in satellite technology, such as high-throughput satellites (HTS) and low-Earth orbit (LEO) constellations, promise faster speeds and lower latency, potentially bridging the digital divide (SpaceNews).

- Emerging markets in Africa and Asia-Pacific are experiencing growth in satellite TV adoption, driven by expanding middle classes and limited terrestrial infrastructure (Balancing Act Africa).

In summary, satellite TV’s journey from space-age innovation to a modern multimedia platform is marked by resilience and adaptation. By embracing technological advancements and hybrid content delivery, the industry is poised to remain a vital part of the global television ecosystem.

Sources & References

- Satellite TV Secrets Unveiled: From Space-Age Origins to the Future of Television

- IMARC Group

- SES

- Statista

- Grand View Research

- Telstar

- BBC

- Streaming Media

- DISH Network

- Sky Group

- Nilesat

- CNBC

- Fierce Video

- MarketsandMarkets

- Leichtman Research Group

- Balancing Act Africa

- ITU

- SpaceNews