Self-Healing Polymer Electronics in 2025: Transforming Device Longevity and Performance. Explore How This Breakthrough Technology is Shaping the Next Generation of Smart Electronics and Driving Double-Digit Market Growth.

- Executive Summary: The State of Self-Healing Polymer Electronics in 2025

- Market Size & Forecast (2025–2030): Growth Trajectory and Key Drivers

- Core Technologies: Mechanisms and Innovations in Self-Healing Polymers

- Key Players and Industry Initiatives (e.g., dupont.com, basf.com, ieee.org)

- Application Landscape: Consumer Electronics, Automotive, Wearables, and Beyond

- Competitive Analysis: Differentiators and Barriers to Entry

- Supply Chain and Manufacturing Trends

- Regulatory Environment and Industry Standards (ieee.org, iso.org)

- Challenges and Limitations: Technical, Economic, and Environmental Factors

- Future Outlook: Disruptive Potential and Strategic Opportunities Through 2030

- Sources & References

Executive Summary: The State of Self-Healing Polymer Electronics in 2025

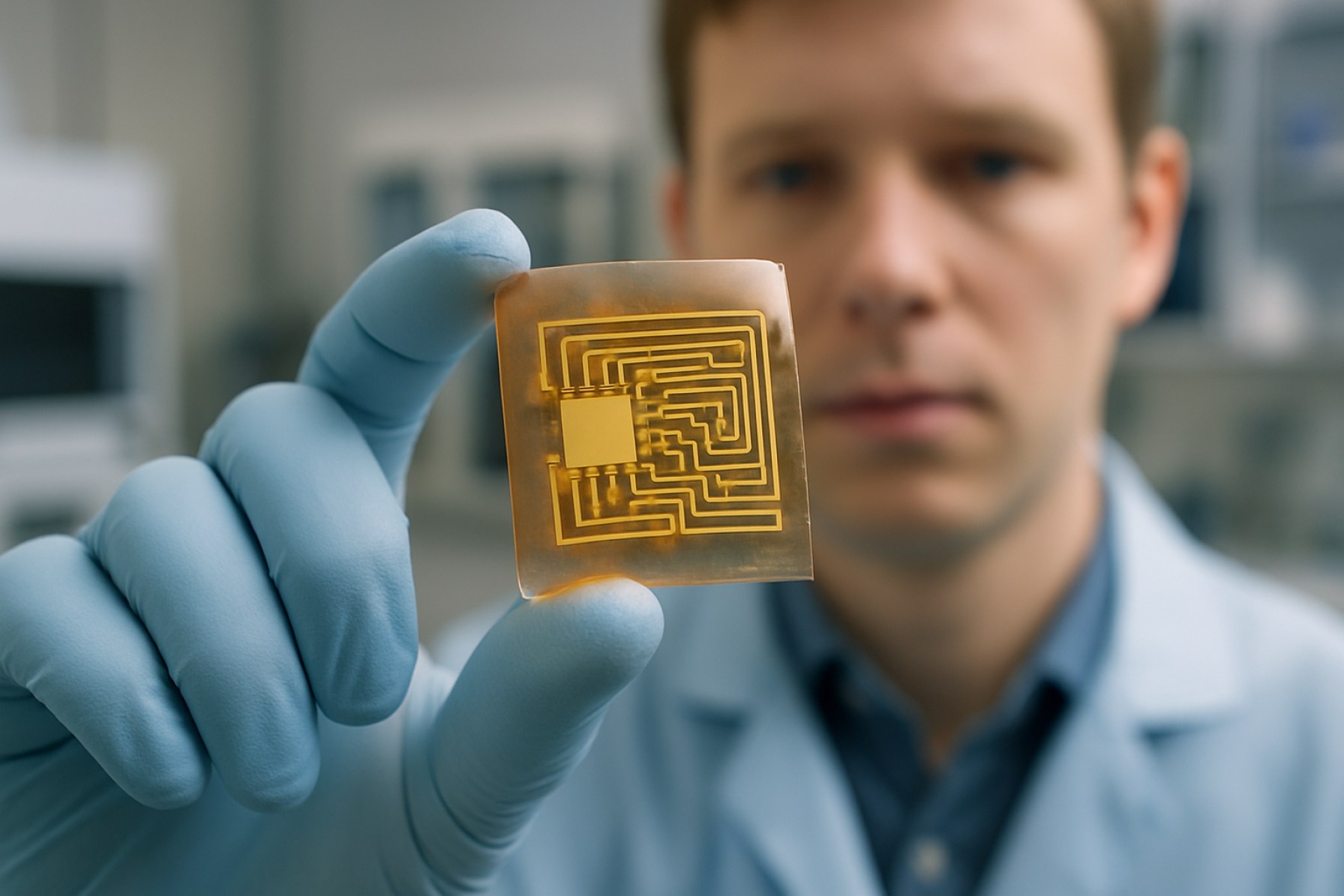

Self-healing polymer electronics have rapidly transitioned from laboratory concepts to early-stage commercial applications by 2025, driven by the demand for more durable, reliable, and sustainable electronic devices. These advanced materials, capable of autonomously repairing mechanical or electrical damage, are being integrated into flexible displays, wearable sensors, and energy storage devices. The sector’s momentum is underpinned by significant investments from leading electronics manufacturers and material science companies, as well as collaborative efforts between industry and academia.

In 2025, several major players are actively developing and commercializing self-healing polymer technologies. LG Electronics has demonstrated flexible OLED displays with self-healing coatings, targeting next-generation smartphones and foldable devices. Samsung Electronics is exploring self-healing materials for wearable electronics, aiming to extend device lifespans and reduce electronic waste. Meanwhile, BASF, a global leader in advanced materials, is supplying self-healing polymer formulations for use in both consumer electronics and automotive sensor applications.

Recent data indicates that self-healing polymer electronics are moving beyond proof-of-concept, with pilot-scale manufacturing lines established in Asia and Europe. For example, LG Chem has announced partnerships with electronics OEMs to supply self-healing polymer films for flexible circuit boards and touch panels. In parallel, DuPont is advancing self-healing dielectric materials for printed circuit boards, focusing on reliability in harsh environments.

The outlook for the next few years is marked by accelerated integration of self-healing polymers into mainstream consumer and industrial electronics. Industry analysts expect that by 2027, self-healing materials will be standard in high-end wearables and foldable devices, with adoption expanding into automotive electronics and IoT sensors. The sector is also witnessing the emergence of startups and university spin-offs, often collaborating with established players to scale up production and address challenges such as cost, scalability, and long-term performance.

Overall, 2025 marks a pivotal year for self-healing polymer electronics, with the technology poised to reshape the durability and sustainability of electronic devices. As leading companies like LG Electronics, Samsung Electronics, BASF, LG Chem, and DuPont continue to invest in R&D and commercialization, the sector is set for robust growth and broader market penetration in the coming years.

Market Size & Forecast (2025–2030): Growth Trajectory and Key Drivers

The global market for self-healing polymer electronics is poised for robust growth between 2025 and 2030, driven by increasing demand for durable, flexible, and reliable electronic devices across multiple sectors. As of 2025, the market is transitioning from early-stage commercialization to broader adoption, particularly in consumer electronics, automotive, and emerging wearable technologies. The integration of self-healing polymers into electronic components—such as flexible circuits, sensors, and energy storage devices—addresses critical challenges related to device longevity, maintenance costs, and sustainability.

Key industry players are accelerating research and development to enhance the mechanical and electrical performance of self-healing materials. Companies like LG Electronics and Samsung Electronics have demonstrated prototypes of flexible displays and wearable devices utilizing self-healing polymer substrates, aiming to reduce screen damage and extend product lifespans. In the automotive sector, Toyota Motor Corporation has explored self-healing coatings and sensors for next-generation vehicles, targeting both safety and cost efficiency.

The market’s growth trajectory is underpinned by several key drivers:

- Consumer Electronics Demand: The proliferation of foldable smartphones, smartwatches, and fitness trackers is fueling the need for resilient, self-repairing materials that can withstand repeated mechanical stress.

- Automotive Electronics: The shift toward electric and autonomous vehicles is increasing the integration of advanced sensors and flexible circuits, where self-healing polymers can significantly reduce maintenance and replacement costs.

- Wearable and Medical Devices: The medical sector is adopting self-healing electronics for skin-contact sensors and implantable devices, where reliability and biocompatibility are paramount.

- Sustainability Initiatives: Self-healing polymers contribute to longer device lifespans and reduced electronic waste, aligning with global sustainability goals and regulatory pressures.

From 2025 onward, the market is expected to experience a compound annual growth rate (CAGR) in the double digits, with Asia-Pacific leading adoption due to the presence of major electronics manufacturers and robust R&D infrastructure. North America and Europe are also anticipated to see significant uptake, particularly in automotive and healthcare applications. Strategic collaborations between material suppliers, such as Dow and BASF, and electronics manufacturers are expected to accelerate commercialization and scale-up of self-healing polymer technologies.

Looking ahead, the next few years will likely see the introduction of commercial products featuring self-healing polymer electronics, with ongoing improvements in healing efficiency, transparency, and conductivity. As manufacturing processes mature and costs decline, self-healing polymers are set to become a standard feature in next-generation electronic devices, reshaping expectations for durability and sustainability in the electronics industry.

Core Technologies: Mechanisms and Innovations in Self-Healing Polymers

Self-healing polymer electronics represent a transformative advance in the field of flexible and wearable devices, offering the potential to extend device lifespans, reduce electronic waste, and enable new applications in harsh or dynamic environments. The core technologies underpinning these systems are based on polymers engineered to autonomously repair mechanical or electrical damage, restoring functionality without external intervention. As of 2025, several mechanisms and innovations are driving rapid progress in this sector.

The primary self-healing mechanisms in polymer electronics can be categorized into intrinsic and extrinsic approaches. Intrinsic self-healing relies on reversible chemical bonds—such as hydrogen bonding, Diels-Alder reactions, or dynamic covalent bonds—integrated directly into the polymer backbone. These materials can repeatedly heal microcracks or breaks when exposed to heat, light, or even at ambient conditions. Extrinsic systems, on the other hand, embed microcapsules or vascular networks filled with healing agents within the polymer matrix; when damage occurs, these agents are released to fill and repair the affected area.

Recent years have seen significant commercial and pre-commercial activity. For example, DuPont has been active in developing advanced polymer materials for flexible electronics, with research efforts focused on enhancing durability and self-repair capabilities. Dow is another major player, leveraging its expertise in specialty polymers to explore self-healing elastomers for electronic applications. Both companies are collaborating with device manufacturers to integrate these materials into next-generation displays, sensors, and wearable devices.

In Asia, LG Chem and Samsung are investing in self-healing polymer research, particularly for foldable smartphones and flexible displays. These companies are exploring polymer blends and coatings that can autonomously repair surface scratches and microfractures, a critical feature for consumer electronics subjected to frequent mechanical stress. Early prototypes have demonstrated the ability to heal visible scratches within minutes at room temperature, a milestone that could soon translate into commercial products.

Looking ahead, the outlook for self-healing polymer electronics is robust. Industry roadmaps suggest that by 2027, self-healing materials will be increasingly integrated into mainstream consumer electronics, medical devices, and soft robotics. The convergence of material science advances and scalable manufacturing processes is expected to lower costs and improve performance, making self-healing features a standard expectation in flexible and wearable electronics. As leading chemical and electronics companies continue to invest in R&D and partnerships, the next few years are likely to see a wave of innovative products leveraging these core self-healing technologies.

Key Players and Industry Initiatives (e.g., dupont.com, basf.com, ieee.org)

The field of self-healing polymer electronics is rapidly evolving, with several major chemical, materials, and electronics companies spearheading research, development, and commercialization efforts. As of 2025, the sector is characterized by a blend of established multinational corporations and innovative startups, each contributing to the advancement and adoption of self-healing materials in electronic applications.

Among the global leaders, DuPont stands out for its extensive portfolio in advanced materials and specialty polymers. DuPont has been actively developing self-healing dielectric and encapsulation materials aimed at flexible displays, wearable electronics, and energy storage devices. Their research focuses on integrating microencapsulated healing agents and dynamic covalent chemistries into polymer matrices, enabling electronic components to recover from mechanical damage and extend operational lifespans.

Another key player, BASF, leverages its expertise in polymer chemistry to create self-healing coatings and conductive polymers. BASF’s initiatives include the development of polyurethane-based systems that autonomously repair microcracks, which is particularly relevant for printed circuit boards and flexible sensors. The company collaborates with electronics manufacturers to tailor these materials for specific device requirements, emphasizing scalability and environmental sustainability.

In Asia, LG Chem is investing in self-healing polymer research for next-generation consumer electronics, including foldable smartphones and flexible displays. LG Chem’s approach involves reversible chemical bonds and supramolecular architectures, which allow materials to self-repair at room temperature without external intervention. This technology is expected to be integrated into commercial products within the next few years, reflecting the company’s commitment to innovation in the electronics sector.

On the industry standards and collaboration front, organizations such as the IEEE are facilitating the development of testing protocols and reliability benchmarks for self-healing electronic materials. IEEE’s involvement ensures that new materials meet rigorous performance and safety standards, which is crucial for widespread adoption in critical applications such as medical devices and automotive electronics.

Looking ahead, the next few years are expected to see increased partnerships between material suppliers, device manufacturers, and research institutions. Companies like DuPont, BASF, and LG Chem are likely to expand their self-healing polymer portfolios, while industry bodies such as IEEE will play a pivotal role in standardizing performance metrics. These coordinated efforts are set to accelerate the commercialization of self-healing electronics, with initial deployments anticipated in consumer devices, automotive systems, and industrial sensors by the late 2020s.

Application Landscape: Consumer Electronics, Automotive, Wearables, and Beyond

The application landscape for self-healing polymer electronics is rapidly expanding, with significant momentum in consumer electronics, automotive systems, wearables, and emerging sectors. As of 2025, the integration of self-healing polymers is transitioning from laboratory prototypes to early-stage commercial products, driven by the demand for enhanced durability, reliability, and sustainability.

In consumer electronics, self-healing polymers are being explored to extend the lifespan of devices such as smartphones, tablets, and flexible displays. These materials can autonomously repair micro-cracks and scratches, reducing the need for repairs and replacements. Companies like LG Electronics have previously demonstrated self-healing coatings in smartphone back panels, and ongoing research suggests that more advanced self-healing functionalities—such as conductive pathways that restore electrical performance after damage—are on the near-term horizon. The push for foldable and rollable devices further accelerates the need for robust, self-repairing materials.

The automotive sector is another key adopter, with self-healing polymers being integrated into both interior and exterior components. These materials can address minor abrasions, chips, and even restore electrical connectivity in sensor-laden surfaces, which is critical for the reliability of advanced driver-assistance systems (ADAS) and electric vehicle (EV) battery management. Major automotive suppliers, including Bosch and Continental, are actively investigating self-healing materials for wiring harnesses, touch interfaces, and protective coatings, aiming to reduce maintenance costs and improve vehicle longevity.

Wearable electronics represent a particularly promising field for self-healing polymers, given the frequent mechanical stress these devices endure. Flexible sensors, smart textiles, and health-monitoring patches benefit from self-healing substrates that maintain function after bending, stretching, or accidental damage. Companies such as Samsung Electronics are investing in flexible, self-healing materials for next-generation wearables, with prototypes already demonstrating repeated healing cycles without significant loss of performance.

Beyond these established markets, self-healing polymer electronics are being explored for use in soft robotics, medical implants, and energy storage devices. The ability to autonomously repair damage in situ is particularly valuable in applications where manual intervention is difficult or impossible. Industry consortia and research collaborations, including those involving DuPont and BASF, are accelerating the development of scalable self-healing polymer systems tailored for these advanced applications.

Looking ahead, the next few years are expected to see broader commercialization as manufacturing processes mature and material costs decrease. The convergence of self-healing polymers with flexible electronics, printed circuits, and sustainable design principles positions this technology as a cornerstone for the next generation of resilient, long-lasting electronic devices across multiple industries.

Competitive Analysis: Differentiators and Barriers to Entry

The competitive landscape for self-healing polymer electronics in 2025 is shaped by a combination of technological innovation, intellectual property, manufacturing capabilities, and strategic partnerships. The sector is characterized by a small but rapidly growing cohort of companies and research institutions, each leveraging unique differentiators to establish market presence while contending with significant barriers to entry.

A primary differentiator is proprietary material science. Companies such as DuPont and Dow have longstanding expertise in polymer chemistry, enabling them to develop self-healing materials with tailored electrical, mechanical, and environmental properties. These firms invest heavily in R&D, resulting in patented formulations and processing techniques that are difficult for new entrants to replicate. For example, DuPont has announced ongoing work on conductive polymers with intrinsic self-healing capabilities, targeting flexible displays and wearable electronics.

Another key differentiator is integration with existing electronic manufacturing processes. Companies like Samsung Electronics and LG Electronics are exploring self-healing polymers for use in foldable devices and next-generation displays. Their established supply chains and advanced fabrication infrastructure provide a significant advantage in scaling up production and ensuring compatibility with current device architectures. This integration is crucial for commercial viability, as it reduces the risk and cost associated with adopting new materials.

Strategic collaborations also play a pivotal role. Partnerships between material suppliers, device manufacturers, and research institutions accelerate the translation of laboratory breakthroughs into market-ready products. For instance, BASF has engaged in joint development agreements with electronics manufacturers to co-develop self-healing coatings and encapsulants for printed circuit boards and sensors.

Barriers to entry remain substantial. The most significant is the high cost and complexity of developing and validating new self-healing polymers that meet stringent electronic performance standards. Extensive testing for reliability, durability, and safety is required, often necessitating years of investment before commercialization. Additionally, the sector is protected by a dense thicket of patents held by established players, making freedom to operate a challenge for startups and smaller firms.

Looking ahead, the competitive environment is expected to intensify as more companies recognize the potential of self-healing electronics in applications such as wearables, automotive interiors, and IoT devices. However, the need for deep technical expertise, robust IP portfolios, and access to advanced manufacturing will continue to limit the number of viable new entrants through the next several years.

Supply Chain and Manufacturing Trends

The supply chain and manufacturing landscape for self-healing polymer electronics is rapidly evolving as the sector transitions from laboratory-scale innovation to commercial-scale production. In 2025, several key trends are shaping the industry, driven by increasing demand for flexible, durable, and sustainable electronic devices across consumer electronics, automotive, and healthcare sectors.

A notable trend is the integration of self-healing polymers into flexible printed circuit boards (PCBs) and wearable devices. Major materials suppliers such as Dow and DuPont are actively developing and scaling up production of advanced polymer resins and encapsulants with intrinsic self-healing properties. These materials are being tailored for compatibility with existing roll-to-roll manufacturing processes, which is critical for cost-effective mass production. Dow has reported ongoing investments in expanding its specialty polymer production lines to meet the anticipated surge in demand from electronics manufacturers.

On the manufacturing front, companies such as Samsung Electronics and LG Electronics are exploring the integration of self-healing materials into next-generation displays and device casings. These firms are collaborating with polymer suppliers to co-develop materials that can be seamlessly incorporated into their existing assembly lines, minimizing the need for disruptive retooling. In 2025, pilot production runs are underway, with commercial launches expected in select product lines within the next two to three years.

Supply chain resilience is a growing focus, particularly in light of recent global disruptions. Leading electronics contract manufacturers such as Foxconn are working to diversify their supplier base for specialty polymers and are investing in localized production capabilities to reduce lead times and mitigate risks associated with long-distance logistics. This trend is expected to accelerate as more OEMs demand secure and transparent sourcing of advanced materials.

Sustainability is also influencing supply chain decisions. Companies like BASF are developing bio-based and recyclable self-healing polymers, responding to both regulatory pressures and consumer demand for greener electronics. These efforts are supported by industry initiatives to standardize material specifications and testing protocols, led by organizations such as the IEEE.

Looking ahead, the next few years will likely see increased collaboration between material innovators, electronics manufacturers, and supply chain partners. The focus will be on scaling up production, reducing costs, and ensuring the reliability of self-healing polymer electronics, paving the way for broader adoption across multiple industries.

Regulatory Environment and Industry Standards (ieee.org, iso.org)

The regulatory environment and industry standards for self-healing polymer electronics are rapidly evolving as the technology matures and moves toward broader commercialization. In 2025, the sector is witnessing increased attention from both international standards organizations and industry consortia, reflecting the growing integration of self-healing materials into flexible electronics, wearables, and emerging smart devices.

The International Organization for Standardization (ISO) plays a pivotal role in setting global standards for polymer materials and electronic components. While there is not yet a dedicated ISO standard specifically for self-healing polymers in electronics, several relevant standards are being referenced and adapted. For instance, ISO 20753 provides standardized nomenclature for polymers, and ISO 1043 covers plastics identification—both foundational for traceability and compliance in self-healing polymer supply chains. Additionally, ISO/TC 61 (Plastics) and ISO/TC 229 (Nanotechnologies) are actively monitoring developments in smart and functional materials, with working groups exploring test methods for durability, environmental impact, and recyclability, all of which are critical for self-healing systems.

On the electronics side, the Institute of Electrical and Electronics Engineers (IEEE) is increasingly involved in standardizing aspects of flexible and printed electronics, which often incorporate self-healing polymers. The IEEE Standards Association (IEEE SA) has published standards such as IEEE 1620 for testing organic electronic devices and is currently reviewing proposals for new standards that address reliability, self-repair mechanisms, and performance metrics specific to self-healing materials. These efforts are expected to accelerate in the next few years as industry adoption grows and as manufacturers seek clear benchmarks for product qualification and interoperability.

Regulatory agencies in major markets, including the U.S. Food and Drug Administration (FDA) and the European Chemicals Agency (ECHA), are also beginning to assess the safety and environmental impact of self-healing polymers, particularly for applications in medical devices and consumer electronics. Compliance with the EU’s REACH regulation and the U.S. Toxic Substances Control Act (TSCA) is increasingly important for manufacturers, prompting closer collaboration between material suppliers and device makers to ensure that new self-healing formulations meet evolving regulatory requirements.

Looking ahead, the next few years are likely to see the introduction of more targeted standards and certification schemes for self-healing polymer electronics, driven by both industry demand and regulatory scrutiny. This will support safer, more reliable products and facilitate global market access, while also encouraging innovation in sustainable and high-performance self-healing materials.

Challenges and Limitations: Technical, Economic, and Environmental Factors

Self-healing polymer electronics represent a promising frontier in flexible and resilient device design, but their widespread adoption faces several technical, economic, and environmental challenges as of 2025 and looking ahead. Technically, the integration of self-healing mechanisms into electronic devices often requires complex material engineering. Most self-healing polymers rely on reversible chemical bonds or microencapsulated healing agents, which can compromise electrical conductivity, mechanical strength, or device miniaturization. For instance, ensuring that the healing process does not interfere with the performance of conductive pathways remains a significant hurdle, especially for high-frequency or high-density circuits. Companies such as DuPont and Dow are actively researching advanced polymer formulations, but achieving a balance between self-healing efficiency and electronic performance is still a work in progress.

Another technical limitation is the speed and repeatability of the healing process. While some self-healing materials can autonomously repair microcracks at room temperature, others require external stimuli such as heat, light, or pressure, which may not be practical for all applications. Furthermore, the long-term reliability of these materials under repeated stress cycles is not yet fully established, raising concerns about their suitability for mission-critical or safety-related electronics.

Economically, the cost of synthesizing and processing self-healing polymers remains higher than that of conventional materials. The need for specialized monomers, catalysts, or encapsulation techniques increases manufacturing complexity and limits scalability. As a result, self-healing electronics are currently more viable for niche applications—such as wearable sensors, medical devices, or aerospace components—where performance and longevity justify the premium. Major material suppliers like BASF and Covestro are exploring cost-reduction strategies, but mass-market adoption will likely depend on further breakthroughs in synthesis and processing.

From an environmental perspective, the sustainability of self-healing polymers is under scrutiny. Many current formulations are based on petrochemical feedstocks and may not be biodegradable or easily recyclable. This raises concerns about end-of-life disposal and the overall ecological footprint of self-healing electronics. Industry leaders such as SABIC are investigating bio-based and recyclable alternatives, but these are still in early development stages.

Looking forward, overcoming these challenges will require coordinated efforts in material science, device engineering, and supply chain innovation. As research continues and pilot projects expand, the next few years will be critical in determining whether self-healing polymer electronics can transition from laboratory prototypes to commercially viable, sustainable products.

Future Outlook: Disruptive Potential and Strategic Opportunities Through 2030

Self-healing polymer electronics are poised to disrupt multiple sectors by 2030, driven by rapid advances in materials science, device engineering, and scalable manufacturing. As of 2025, the field is transitioning from laboratory-scale demonstrations to early-stage commercialization, with significant investments from both established electronics manufacturers and innovative startups. The core value proposition—electronic devices that autonomously repair mechanical or electrical damage—addresses critical pain points in consumer electronics, automotive, aerospace, and medical devices, where reliability and longevity are paramount.

Key industry players are accelerating the integration of self-healing polymers into flexible circuits, wearable sensors, and energy storage devices. For example, Samsung Electronics has publicly disclosed R&D efforts in flexible and self-healing display materials, aiming to enhance the durability of foldable smartphones and next-generation wearables. Similarly, LG Electronics is exploring self-healing coatings for OLED panels and flexible batteries, targeting both consumer and automotive applications. In the automotive sector, Toyota Motor Corporation has invested in self-healing polymer research for in-vehicle electronics and sensor systems, seeking to reduce maintenance costs and improve safety.

The next few years are expected to see the first commercial launches of self-healing electronic components, particularly in high-value, mission-critical applications. For instance, medical device manufacturers are evaluating self-healing polymers for implantable electronics and biosensors, where device failure can have severe consequences. The aerospace industry, led by companies such as Boeing, is investigating self-healing wiring and sensor networks to enhance aircraft reliability and reduce downtime.

Strategically, the adoption of self-healing polymer electronics offers opportunities for differentiation and cost savings. Manufacturers can extend product lifespans, reduce warranty claims, and enable new form factors that were previously impractical due to fragility concerns. The technology also aligns with sustainability goals by minimizing electronic waste and supporting circular economy initiatives.

Looking toward 2030, the disruptive potential of self-healing polymer electronics will depend on overcoming challenges related to large-scale manufacturing, integration with existing device architectures, and long-term material stability. Industry consortia and standards bodies, such as the IEEE, are expected to play a pivotal role in establishing performance benchmarks and interoperability standards. As the ecosystem matures, collaborations between material suppliers, device manufacturers, and end-users will be critical to unlocking the full strategic value of self-healing electronics across industries.

Sources & References

- LG Electronics

- BASF

- DuPont

- Toyota Motor Corporation

- IEEE

- Bosch

- Foxconn

- International Organization for Standardization (ISO)

- Covestro

- Boeing